Introduction

The stock market in the United States is often seen as a bellwether for the broader economy. When the stock market experiences a significant drop, it can have wide-ranging effects on various sectors and individuals. In this article, we will explore the effects of a stock market drop in the US, including its impact on investors, businesses, and the overall economy.

Impact on Investors

One of the most immediate effects of a stock market drop is on investors. Many investors see their portfolios shrink, which can lead to feelings of anxiety and panic. For long-term investors, this may be an opportunity to buy stocks at a lower price. However, for short-term investors or those nearing retirement, the drop can be a significant concern.

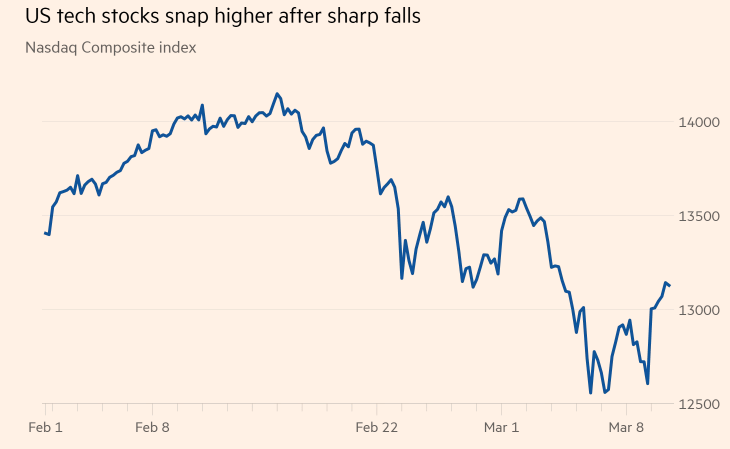

Case Study: 2020 Stock Market Crash

The stock market crash of 2020, triggered by the COVID-19 pandemic, is a prime example of how a stock market drop can impact investors. The S&P 500 dropped over 30% in just a few weeks, causing many investors to lose a substantial amount of their savings. However, some investors saw this as a buying opportunity, leading to a swift recovery in the market by the end of the year.

Impact on Businesses

A stock market drop can also have a significant impact on businesses. When the stock market drops, it can lead to decreased consumer confidence, which in turn can lead to decreased spending. This can be particularly damaging for businesses that rely on consumer spending.

Furthermore, a stock market drop can make it more difficult for businesses to raise capital. When stock prices are low, it becomes harder for companies to go public or raise funds through stock offerings.

Impact on the Economy

The stock market is a critical component of the overall economy. When the stock market drops, it can lead to a decrease in consumer spending, which can, in turn, lead to a slowdown in economic growth.

Impact on the Labor Market

A stock market drop can also have a negative impact on the labor market. As businesses struggle due to decreased consumer spending and increased difficulty in raising capital, they may be forced to lay off employees or cut wages. This can lead to increased unemployment rates and decreased income levels.

Conclusion

In conclusion, a stock market drop in the US can have far-reaching effects on investors, businesses, and the overall economy. While some may see opportunities in a drop, it's essential to recognize the potential risks and implications. As always, it's crucial to seek advice from a financial advisor before making any investment decisions.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....