Introduction:

The question of whether the US stock market is overvalued has been a topic of debate among investors and economists for years. With record-high stock prices and a soaring market, some are worried that the market may be on the brink of a correction. In this article, we will explore the factors contributing to the current market conditions and whether the US stock market is indeed too high.

Market Valuation Metrics:

To determine if the US stock market is overvalued, it's essential to consider various market valuation metrics. One of the most commonly used metrics is the price-to-earnings (P/E) ratio. This ratio compares the current market price of a stock to its per-share earnings. As of the latest data, the S&P 500's P/E ratio is around 22.8, which is slightly above its long-term average of around 18. While this indicates that the market may be slightly overvalued, it is not necessarily a sign of impending doom.

Another metric to consider is the cyclically adjusted price-to-earnings (CAPE) ratio, also known as the Shiller P/E ratio. This metric looks at the average inflation-adjusted earnings over the past 10 years. As of now, the CAPE ratio for the S&P 500 stands at around 31.3, which is above its long-term average of 16. This suggests that the market is significantly overvalued based on this metric.

Economic Factors:

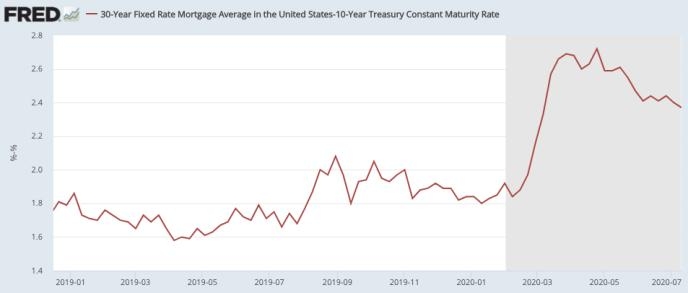

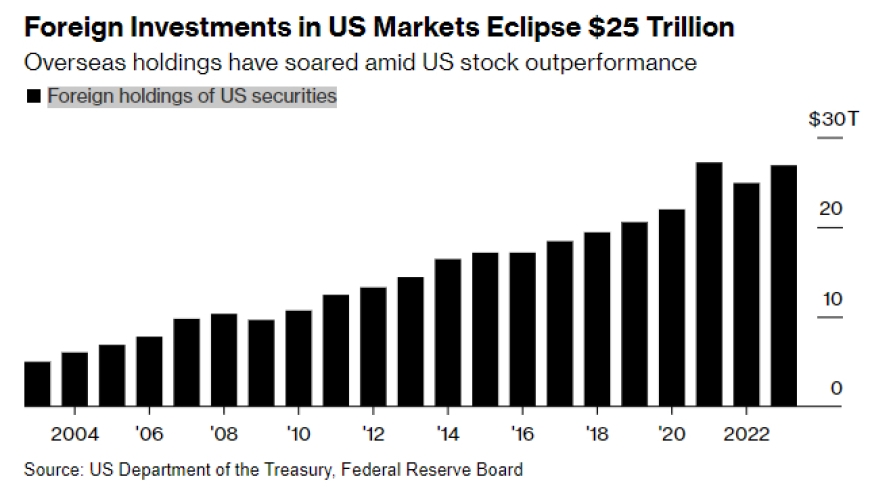

Several economic factors have contributed to the current high valuations in the US stock market. The Federal Reserve's low-interest-rate policy has pushed investors to seek higher yields in riskier assets, such as stocks. Additionally, strong corporate earnings and low unemployment have bolstered investor confidence.

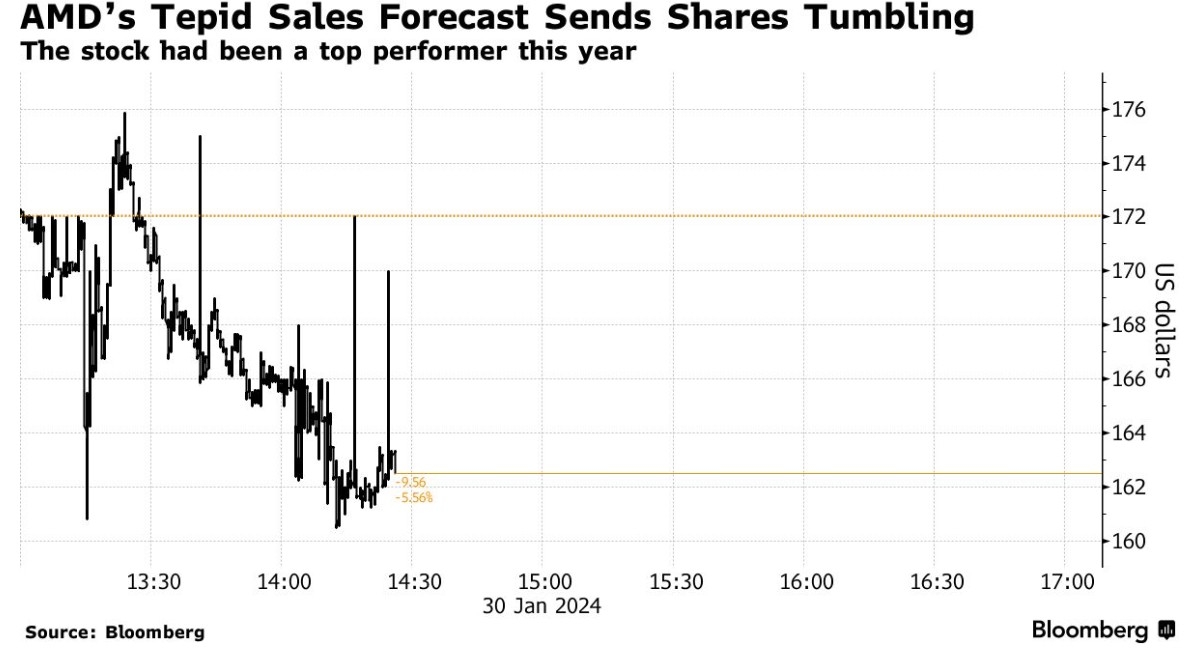

Sector Analysis:

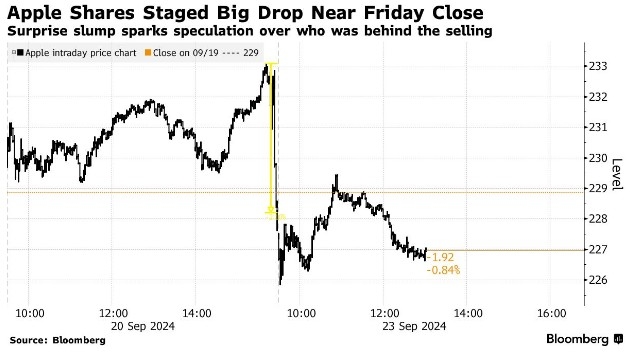

While the overall market may be overvalued, certain sectors have seen more significant gains than others. Tech stocks, in particular, have surged over the past few years, driven by companies like Apple, Amazon, and Microsoft. However, this sector may be overvalued, with some analysts suggesting that it may be due for a pullback.

Case Studies:

To illustrate the potential risks associated with high stock market valuations, we can look at historical examples. In the late 1990s, the tech bubble saw the NASDAQ index soar to unprecedented levels. When the bubble burst in 2000, the index plummeted by more than 75%, causing significant damage to investors' portfolios.

Another example is the dot-com bubble of the early 2000s. This bubble was fueled by the rapid growth of internet companies and the belief that the internet would disrupt all aspects of the economy. When the bubble burst, many investors lost a significant portion of their investments.

Conclusion:

While the US stock market may be overvalued based on certain metrics, it is essential to recognize that the market has historically been cyclical. Investors should consider diversifying their portfolios and stay focused on long-term investing rather than trying to time the market. It is crucial to conduct thorough research and consult with a financial advisor before making any investment decisions.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....