Introduction

The United Kingdom's decision to leave the European Union, commonly known as Brexit, has been a topic of intense discussion around the world. With the UK's official exit from the EU scheduled for January 31, 2020, investors are increasingly concerned about the potential impact on the global economy, including the US stock market. This article explores how Brexit might affect the US stock market, considering various economic factors and historical data.

Brexit and Its Economic Implications

Brexit has the potential to disrupt global trade, investment, and economic stability. The uncertainty surrounding the UK's future trading relationship with the EU has led to concerns about slower economic growth, higher inflation, and increased political tensions. These factors could have a significant impact on the US stock market, particularly in industries that rely heavily on trade with the UK and the EU.

Impact on the US Stock Market

1. Sector-Specific Impacts

- Technology and Financial Services: Many technology and financial services companies have significant operations in the UK and the EU. A disruption in trade could lead to lower revenues for these companies, potentially impacting their stock prices.

- Consumer Goods: Companies that sell consumer goods in the UK and the EU may face higher transportation costs and supply chain disruptions, which could lead to lower profits and decreased stock values.

- Energy Sector: The UK is a significant player in the energy market, particularly in natural gas and oil. Disruptions in energy supply or changes in energy prices could affect the energy sector, including companies listed on the US stock market.

2. Market Sentiment

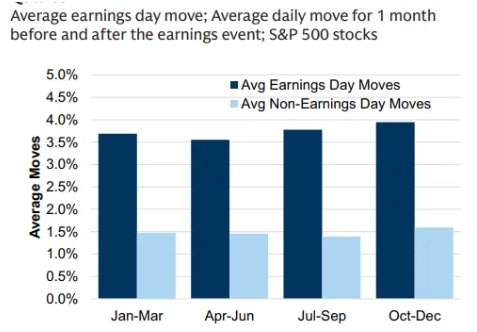

Brexit has created uncertainty in the global markets, which can lead to volatility. Investors may become more risk-averse, leading to a sell-off in stocks. This could have a negative impact on the US stock market, particularly if the uncertainty persists for an extended period.

3. Currency Fluctuations

The value of the British pound has been volatile since the Brexit referendum in 2016. If the pound continues to weaken, it could lead to higher import prices for US companies and inflationary pressures. This could negatively impact the US stock market, particularly for companies with significant international operations.

Historical Examples

Historical examples of political and economic uncertainty, such as the 2008 financial crisis and the 2016 US presidential election, have shown that the stock market can be highly sensitive to such events. In these instances, the stock market experienced significant volatility, which suggests that Brexit could have a similar impact.

Conclusion

Brexit is a complex issue with significant economic implications. While it is difficult to predict the exact impact on the US stock market, it is clear that the uncertainty surrounding the UK's exit from the EU could lead to volatility and potential losses. Investors should closely monitor the situation and consider diversifying their portfolios to mitigate risks.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....