The stock market is a vital indicator of the health of the economy, and its fluctuations can significantly impact investors and the general public. If you're wondering, "How much is the US stock market down?" this article will provide you with a comprehensive overview of the current situation and the factors contributing to the decline.

Understanding the Stock Market Decline

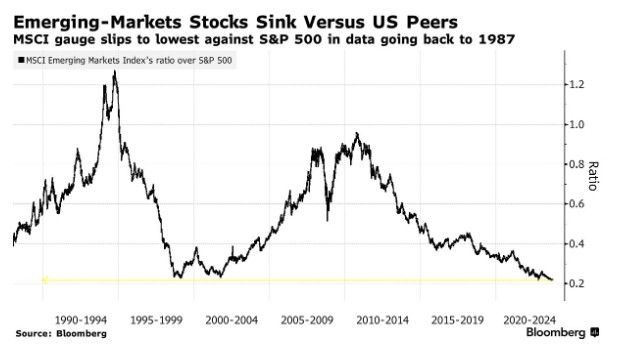

The US stock market has experienced a downturn in recent months, with various factors contributing to the decline. To answer the question, "How much is the US stock market down?" we need to look at the overall performance of major indices such as the S&P 500, the Dow Jones Industrial Average, and the NASDAQ.

As of the latest data, the S&P 500 has fallen by approximately 20% from its all-time high in early 2022. The Dow Jones Industrial Average has also experienced a similar decline, with a drop of around 18% from its peak. The NASDAQ, which is heavily weighted towards technology stocks, has seen an even more significant drop, with a decrease of approximately 25% from its all-time high.

Factors Contributing to the Stock Market Decline

Several factors have contributed to the current stock market downturn:

Inflation Concerns: Rising inflation has been a major concern for investors, as it erodes purchasing power and can lead to higher interest rates. The Federal Reserve has been raising interest rates to combat inflation, which has added to the uncertainty in the stock market.

Geopolitical Tensions: Tensions between the US and other major economies, such as China, have also contributed to the stock market decline. These tensions have raised concerns about global economic stability and have led to increased volatility in the markets.

Economic Slowdown: There are growing concerns about a potential economic slowdown, both in the US and globally. This has led to increased caution among investors, resulting in a sell-off of stocks.

COVID-19 Pandemic: Although the pandemic is no longer a major concern, its impact on the economy and corporate earnings is still being felt. Many companies have yet to fully recover from the disruptions caused by the pandemic, which has contributed to the stock market decline.

Case Studies

To illustrate the impact of the stock market downturn, let's look at a few case studies:

Tesla: Tesla, one of the most valuable companies in the world, has seen its stock price fall by approximately 40% from its all-time high. This decline can be attributed to concerns about the company's ability to meet production targets and the increasing competition in the electric vehicle market.

Apple: Apple, another major tech giant, has also experienced a decline in its stock price, with a drop of around 20% from its peak. This decline can be attributed to concerns about the company's growth prospects and the increasing competition in the smartphone market.

Walmart: Walmart, a retail giant, has seen its stock price fall by approximately 15% from its all-time high. This decline can be attributed to concerns about the company's ability to compete with online retailers and the impact of rising inflation on consumer spending.

In conclusion, the US stock market has experienced a significant downturn in recent months, with various factors contributing to the decline. If you're wondering, "How much is the US stock market down?" the answer is that major indices have fallen by approximately 20-25% from their all-time highs. As investors, it's important to stay informed about the factors contributing to the market downturn and to make informed decisions based on your investment strategy.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....