In the world of financial reporting, understanding how to account for various types of equity compensation is crucial. One such form of compensation is the Restricted Stock Unit (RSU), which is becoming increasingly popular among companies. This article delves into the complexities of accounting for RSUs under the United States Generally Accepted Accounting Principles (US GAAP).

What are RSUs?

RSUs are a form of equity compensation where an employee is granted the right to receive shares of company stock in the future. Unlike stock options, which give employees the right to buy shares at a predetermined price, RSUs are simply a promise to deliver shares. The key difference lies in the vesting period, which determines when the employee becomes entitled to the shares.

Accounting for RSUs Under US GAAP

Accounting for RSUs under US GAAP can be complex. The primary accounting issue revolves around the recognition and measurement of the cost associated with the grant of RSUs. According to ASC 718, companies must recognize the cost of RSUs over the vesting period as an expense on their income statement.

Recognition and Measurement

The recognition and measurement of RSUs under US GAAP follow a straightforward process:

- Grant Date: When an RSU is granted, the company estimates the fair value of the shares at that time. This fair value is typically determined using a valuation model.

- Recognition: The company recognizes the cost of the RSUs over the vesting period. The expense is recognized on a straight-line basis, meaning the same amount is recognized each period until the RSUs vest.

- Measurement: The fair value of the RSUs at the grant date is used to measure the expense. If the fair value changes over time, the company may need to adjust the expense accordingly.

Vesting and Amortization

The vesting period for RSUs can vary, but it is typically determined by the company's policy. During the vesting period, the expense is recognized on the income statement. Once the RSUs vest, the employee becomes entitled to receive the shares.

Example:

Let's say a company grants an RSU to an employee with a fair value of

Case Studies

Several companies have faced challenges in accounting for RSUs under US GAAP. One notable example is Google, which faced criticism for its accounting treatment of RSUs. In 2011, Google changed its accounting policy for RSUs, resulting in a significant restatement of its financial statements.

Conclusion

Understanding how to account for RSUs under US GAAP is essential for companies and investors alike. By recognizing the cost of RSUs over the vesting period, companies can provide a more accurate picture of their financial performance. As RSUs continue to grow in popularity, it is crucial for companies to stay informed about the latest accounting guidance.

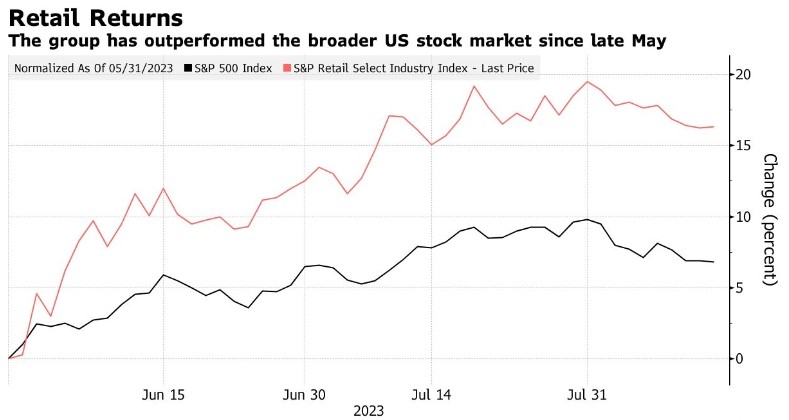

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....