As we delve into the second half of 2025, the US stock market is poised for a pivotal period. This article provides a comprehensive analysis of the US stock market, focusing on key trends, sectors, and potential risks and opportunities for investors.

Market Overview

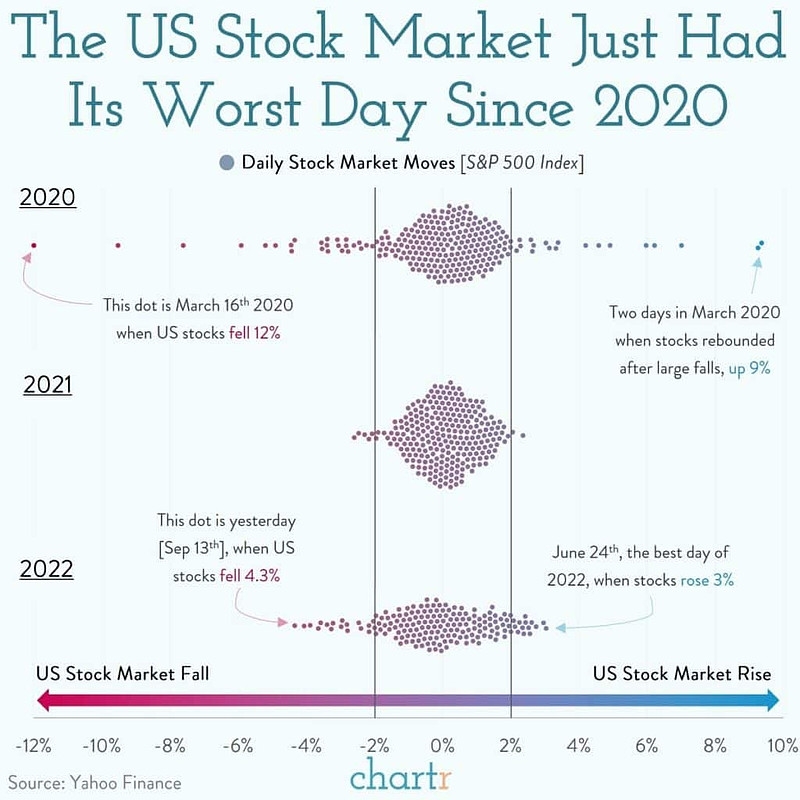

The US stock market has experienced a rollercoaster ride over the past few years, with significant volatility. However, as we approach July 2025, the market is showing signs of stability and growth. The S&P 500, a widely followed index, has been on an upward trajectory, reflecting a strong economic recovery and improving corporate earnings.

Trends to Watch

Tech Sector: The tech sector remains a key driver of the US stock market. Companies like Apple, Microsoft, and Amazon have continued to grow their market share and generate substantial profits. Additionally, the rise of artificial intelligence and machine learning is expected to further boost the tech sector's performance.

Energy Sector: The energy sector has seen a remarkable turnaround, driven by the surge in oil prices and the increased production of natural gas. Companies in this sector, such as ExxonMobil and Chevron, have seen their stock prices soar, making them attractive investments for risk-tolerant investors.

Healthcare Sector: The healthcare sector is also a promising area for investors. With the aging population and the growing demand for medical services, companies in this sector are expected to see sustained growth. Biotechnology companies, in particular, are poised to benefit from advancements in drug development and personalized medicine.

Case Study: Tesla

Tesla, the electric vehicle (EV) manufacturer, has been a standout performer in the stock market. Its stock price has surged over the past few years, driven by strong sales and the company's ambitious expansion plans. As Tesla continues to increase its production capacity and introduce new models, it is expected to maintain its position as a market leader in the EV industry.

Risks and Opportunities

While the US stock market presents numerous opportunities, investors should also be aware of potential risks:

Inflation: Inflation remains a concern for investors, as it can erode the purchasing power of their investments. The Federal Reserve's monetary policy and its impact on interest rates will be closely monitored.

Geopolitical Tensions: Geopolitical tensions, such as trade disputes and political instability, can create uncertainty in the market and lead to volatility.

Corporate Earnings: The sustainability of corporate earnings will be crucial for the stock market's performance. Companies that can demonstrate strong growth and profitability will likely outperform their peers.

Conclusion

The US stock market is expected to remain robust in July 2025, with several sectors offering promising opportunities for investors. However, it is crucial to stay informed about market trends, risks, and opportunities to make informed investment decisions. As always, diversification and a well-thought-out investment strategy are key to achieving long-term success in the stock market.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....