In recent weeks, many investors have been scratching their heads, wondering why stocks are down. The stock market is a complex and dynamic entity, influenced by a myriad of factors. This article delves into the key reasons behind the market decline and provides insights into how investors can navigate these challenging times.

Economic Factors

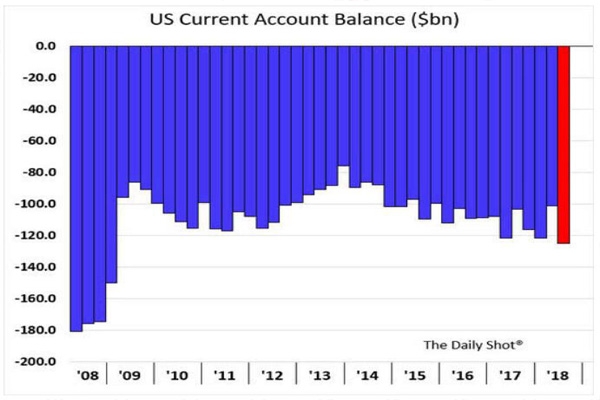

One of the primary reasons for the stock market downturn is economic uncertainty. The global economy has been facing various challenges, including slowing growth in major economies like China and the United States. Slowing GDP growth, inflation concerns, and geopolitical tensions have all contributed to the downward trend in the stock market.

Interest Rate Hikes

Another significant factor is the increase in interest rates by central banks. The Federal Reserve and other central banks around the world have been raising interest rates to combat inflation. While higher interest rates can help control inflation, they can also lead to higher borrowing costs for businesses and consumers, which can negatively impact stock prices.

Market Volatility

Market volatility has been a constant feature in recent months. Geopolitical events, such as the conflict in Ukraine, and the rise of new variants of the COVID-19 virus have caused uncertainty and instability in the market. Investors often react to these events by selling off stocks, leading to a decline in stock prices.

Valuation Concerns

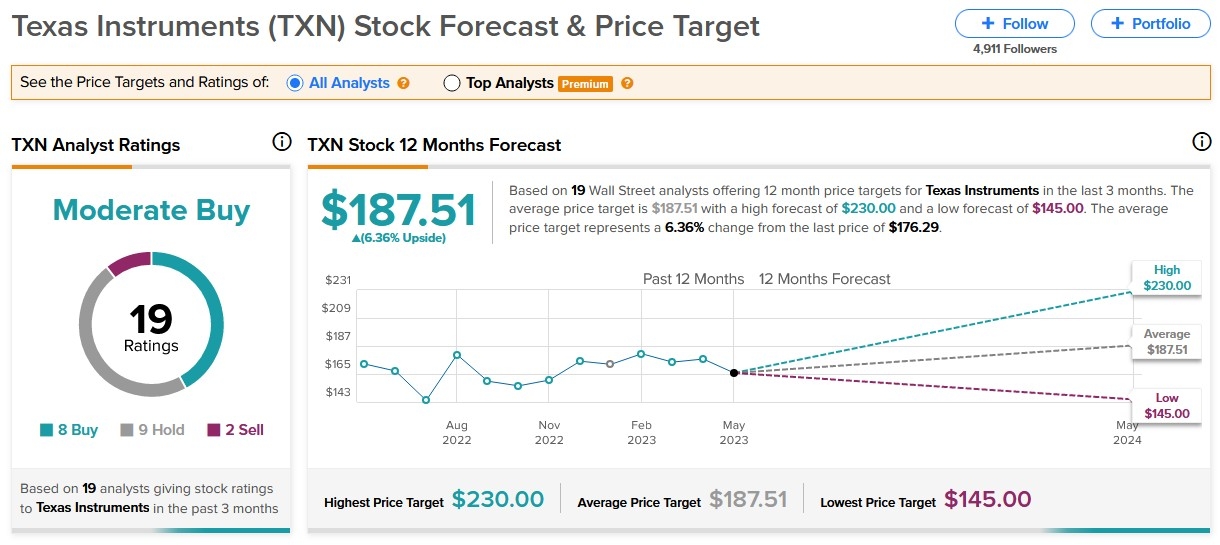

The stock market has been on a bull run for several years, and some investors believe that stocks are now overvalued. High valuations can make stocks vulnerable to downward corrections. As investors become concerned about the sustainability of stock prices, they may start selling off, leading to a decline in stock prices.

Technological Advancements

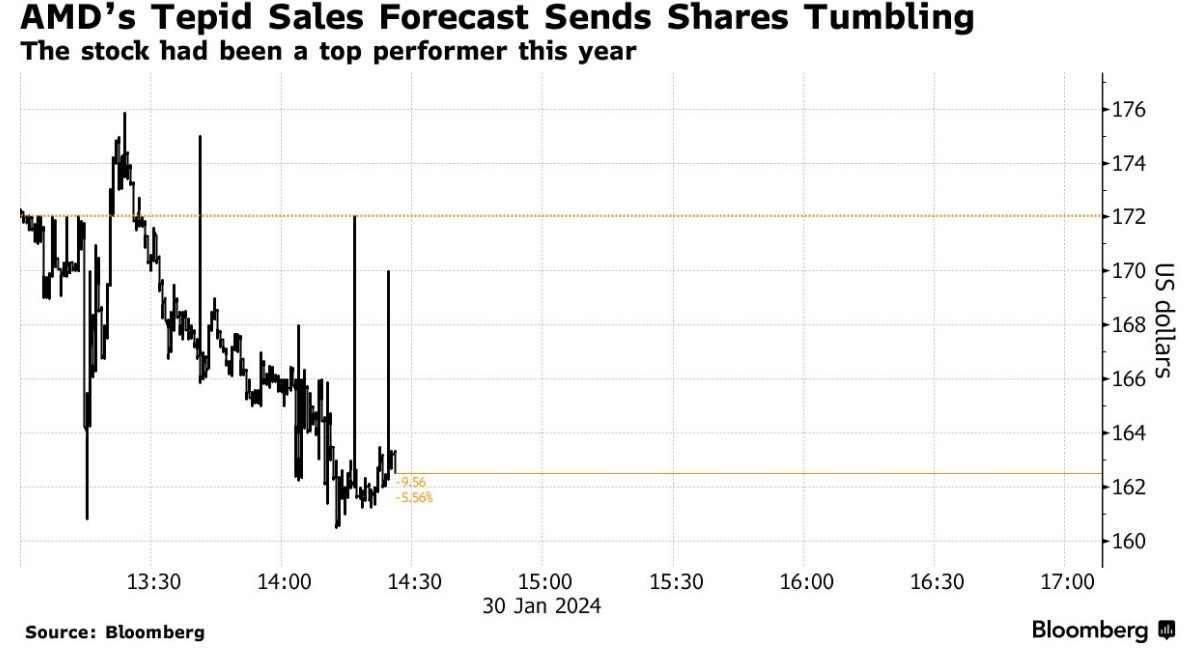

Technological advancements can also impact the stock market. For example, the rise of artificial intelligence and machine learning has led to increased competition in various industries. This competition can lead to lower profits for companies, which can, in turn, lead to a decline in stock prices.

Case Studies

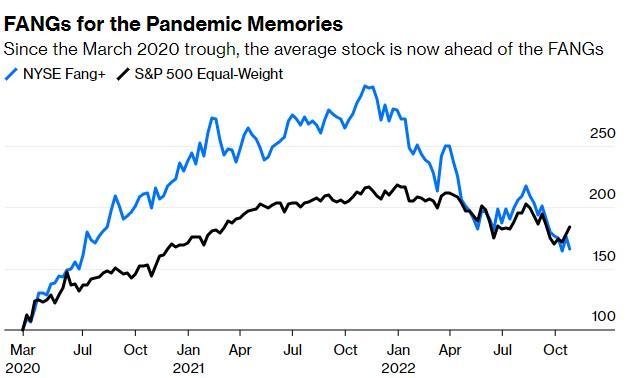

One notable example of a market downturn due to valuation concerns is the tech sector in 2022. As investors became concerned about the high valuations of tech stocks, they started selling off, leading to a significant decline in stock prices. This decline was further exacerbated by the rising interest rates and economic uncertainty.

Another example is the energy sector in 2020. The COVID-19 pandemic led to a significant decline in demand for oil and gas, causing the prices of these commodities to plummet. This, in turn, led to a decline in the stock prices of energy companies.

Conclusion

The decline in the stock market can be attributed to a combination of economic factors, market volatility, valuation concerns, and technological advancements. As investors, it is essential to stay informed and understand these factors to make informed decisions. By staying focused on long-term goals and maintaining a diversified portfolio, investors can navigate these challenging times and potentially benefit from future market recoveries.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....