In the ever-evolving global market, investors often find themselves at a crossroads when deciding whether to stick with US stocks. With a wide array of investment opportunities available, it's essential to weigh the pros and cons of maintaining a focus on the United States. In this article, we will explore the reasons why sticking with US stocks might be a wise decision, along with some key considerations to keep in mind.

Understanding the US Stock Market

The US stock market, also known as the American stock market, is one of the largest and most diverse in the world. It encompasses a wide range of industries, from technology giants like Apple and Microsoft to traditional sectors such as healthcare and finance. Here are some reasons why you might consider sticking with US stocks:

Strong Economic Foundation: The United States boasts a robust economy with low inflation and strong growth prospects. This stability makes US stocks a reliable investment option for long-term investors.

Innovative Companies: The US is home to numerous innovative companies that drive technological advancements and economic growth. Investing in these companies can provide exposure to emerging trends and potentially high returns.

Regulatory Environment: The US has a well-regulated stock market that protects investors and ensures fair trading practices. This regulatory framework can help mitigate risks and promote market stability.

Diverse Portfolio Opportunities: The US stock market offers a wide range of investment options, allowing you to build a diversified portfolio tailored to your risk tolerance and investment goals.

Key Considerations

While there are several advantages to sticking with US stocks, it's crucial to consider the following factors:

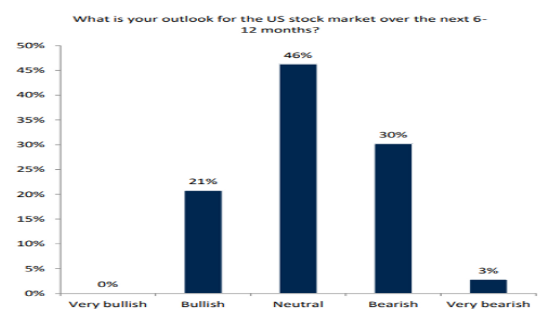

Market Volatility: The US stock market can be volatile, especially during economic downturns or geopolitical events. It's important to stay informed and be prepared for potential market fluctuations.

Currency Fluctuations: If you're investing in US stocks from a foreign country, currency fluctuations can impact your returns. Consider the potential risks associated with currency exchange rates.

Sector Rotation: Different sectors perform better at different times. Sticking with US stocks may require you to adapt your portfolio to changing market conditions and sector trends.

Diversification Beyond US Stocks: While US stocks offer a wide range of investment opportunities, it's important to consider diversifying your portfolio beyond the US to mitigate risks associated with country-specific market fluctuations.

Case Study: Apple Inc.

To illustrate the potential benefits of investing in US stocks, let's consider Apple Inc. (AAPL), a leading technology company. Since its initial public offering in 1980, Apple has become one of the most valuable companies in the world. By investing in Apple, investors have enjoyed significant returns, driven by the company's innovation, strong brand, and market dominance.

In conclusion, whether you should stick with US stocks depends on your investment goals, risk tolerance, and market conditions. While the US stock market offers numerous advantages, it's essential to consider the potential risks and stay informed about market trends. By carefully evaluating your investment strategy and diversifying your portfolio, you can make informed decisions that align with your financial objectives.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....