Are you looking to diversify your investment portfolio and tap into the vast opportunities offered by the US stock market? If you're in Vietnam, you might be wondering how to go about investing in US stocks. Don't worry; it's easier than you might think! In this article, we will guide you through the process of investing in US stocks from Vietnam, highlighting the steps you need to follow and the key factors to consider.

Understanding the Basics

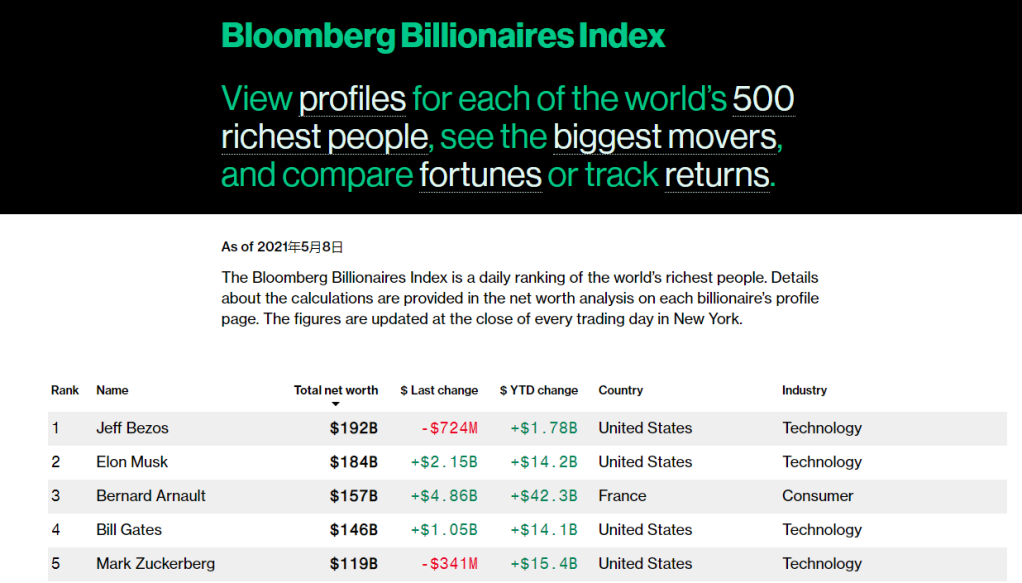

Before diving into the process, it's important to understand the basics of the US stock market. The stock market is a platform where companies can issue shares to raise capital, and investors can buy and sell these shares. The US stock market is one of the largest and most liquid in the world, with several major exchanges like the New York Stock Exchange (NYSE) and the NASDAQ.

Opening a Brokerage Account

The first step in investing in US stocks from Vietnam is to open a brokerage account with a reputable brokerage firm. A brokerage firm acts as an intermediary between you and the stock market, facilitating the buying and selling of stocks. There are several brokerage firms that offer services to international investors, including TD Ameritrade, E*TRADE, and Charles Schwab.

When choosing a brokerage firm, consider the following factors:

- Fees and Commissions: Different brokerage firms charge varying fees for trading, so it's important to compare the fees and choose a firm that fits your budget.

- Platform and Tools: Look for a brokerage firm that offers a user-friendly platform with a range of tools to help you analyze and manage your investments.

- Customer Support: Choose a brokerage firm with reliable customer support, as you may need assistance during the investment process.

Understanding the Risks

Investing in US stocks involves risks, just like any other investment. It's important to understand these risks and assess whether you're prepared to take them. Some of the key risks include market risk, liquidity risk, and currency risk.

- Market Risk: The value of your investments can fluctuate due to changes in the market.

- Liquidity Risk: If you need to sell your investments quickly, you may not be able to do so at a favorable price.

- Currency Risk: If the Vietnamese Dong weakens against the US Dollar, your returns in Vietnamese currency may be lower.

Investing Strategies

Once you have opened a brokerage account, you can start investing in US stocks. Here are some common investment strategies:

- Diversification: Invest in a variety of stocks across different sectors and industries to reduce your risk.

- Index Funds: Consider investing in index funds that track the performance of a specific index, such as the S&P 500.

- Dividend Stocks: Invest in companies that pay dividends, which can provide a regular income stream.

Case Studies

To illustrate the process, let's consider a hypothetical case. Mr. Tran, a Vietnamese investor, decides to invest

Conclusion

Investing in US stocks from Vietnam is a viable option for investors looking to diversify their portfolios and tap into the global market. By understanding the basics, choosing the right brokerage firm, and implementing a sound investment strategy, you can start investing in US stocks and potentially achieve your financial goals.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....