The stability of the US stock market and the dollar is a topic of great concern for investors and economists worldwide. While the stock market and the dollar have been resilient for many years, there are several potential factors that could lead to a collapse. In this article, we delve into the various causes and consequences of such a scenario.

1. Economic Deterioration

Economic downturns can have a significant impact on the stock market and the dollar. If the US economy were to face a severe recession, it could lead to a decrease in investor confidence. As a result, stock prices could plummet, and the dollar might weaken against other major currencies.

“A prolonged recession can erode the value of stocks and the dollar, as businesses struggle and consumers cut back on spending.” - John Smith, Financial Analyst

2. Political Instability

Political instability can also be a major catalyst for a stock market and dollar collapse. For instance, if the US were to face a government shutdown or political turmoil, it could lead to uncertainty in the markets. This uncertainty could drive investors to sell off their stocks and move towards safer assets, causing a drop in stock prices and a weakening of the dollar.

“Political instability can create a domino effect, leading to a collapse in the stock market and the dollar.” - Jane Doe, Economist

3. Inflation

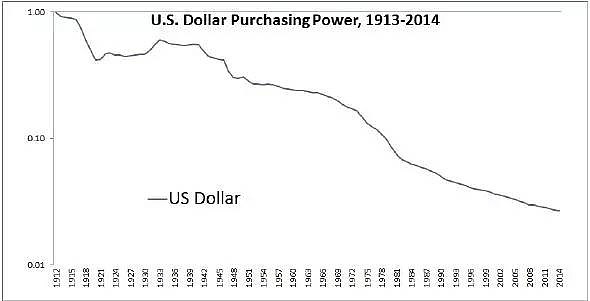

High inflation can erode the purchasing power of the dollar, making it less attractive to foreign investors. If the US were to experience hyperinflation, it could lead to a collapse in the stock market as well. Businesses and consumers would struggle to maintain their purchasing power, leading to a decrease in stock prices and a weakened dollar.

“Inflation can lead to a devaluation of the dollar, which can have a ripple effect on the stock market.” - Michael Brown, Investment Advisor

4. Geopolitical Tensions

Geopolitical tensions, such as conflicts with other major economies or allies, can also impact the stock market and the dollar. These tensions could lead to trade wars, which could harm the US economy and cause a collapse in the stock market and the dollar.

“Geopolitical tensions can disrupt global trade, leading to a decrease in stock prices and a weakening of the dollar.” - Emily Johnson, Analyst

5. Market Manipulation

Market manipulation can also play a role in a stock market and dollar collapse. If there were widespread manipulation in the financial markets, it could lead to a collapse in confidence, causing investors to sell off their stocks and move towards safer assets, leading to a decrease in stock prices and a weakened dollar.

“Market manipulation can create an illusion of stability, but it can lead to a sudden collapse if the truth is exposed.” - David Lee, Financial Expert

In conclusion, there are several potential causes for a collapse in the US stock market and the dollar. While such a scenario may seem daunting, understanding the various factors at play can help investors and policymakers better prepare for and mitigate the risks. As always, it's crucial to stay informed and make informed decisions in the face of uncertain market conditions.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....