Are you a U.S. investor looking to expand your portfolio with a slice of the global tech giant, Samsung? If so, you're not alone. Samsung, a household name in electronics, has captured the interest of investors worldwide. In this article, we'll delve into the details of whether U.S. investors can buy Samsung stock, the benefits, and potential risks involved.

Can U.S. Investors Buy Samsung Stock? The Answer is Yes

Absolutely, U.S. investors can buy Samsung stock. However, it's important to note that Samsung is a South Korean company, and its stock is listed on the Korean Exchange (KRX). So, to purchase Samsung stock, U.S. investors will need to go through a brokerage that offers international trading services.

How to Buy Samsung Stock as a U.S. Investor

Open an International Trading Account: To buy Samsung stock, you'll need to open an international trading account with a brokerage that offers access to the KRX. Some popular options include TD Ameritrade, E*TRADE, and Charles Schwab.

Familiarize Yourself with the Risks: Trading international stocks involves additional risks, such as currency fluctuations and different regulatory frameworks. It's crucial to understand these risks before investing.

Understand the Samsung Stock Symbol: Samsung's stock symbol on the KRX is 005930.KS. Make sure you enter the correct symbol when placing your order.

Place Your Order: Once you have an international trading account and understand the risks, you can place your order to buy Samsung stock.

Benefits of Investing in Samsung Stock

Strong Financial Performance: Samsung has a long history of strong financial performance, with consistent growth in revenue and profits.

Market Leader: Samsung is a market leader in several key sectors, including smartphones, TVs, and semiconductors. This position gives the company a competitive advantage and potential for continued growth.

Dividend Yield: Samsung offers a dividend yield, which can provide a source of income for investors.

Risks of Investing in Samsung Stock

Currency Fluctuations: Trading international stocks exposes investors to currency risk, as the value of the South Korean won can fluctuate against the U.S. dollar.

Regulatory Risks: Different regulatory frameworks in South Korea may affect Samsung's operations and financial performance.

Competition: The tech industry is highly competitive, and Samsung faces challenges from other global players like Apple and Huawei.

Case Study: Samsung's Recent Stock Performance

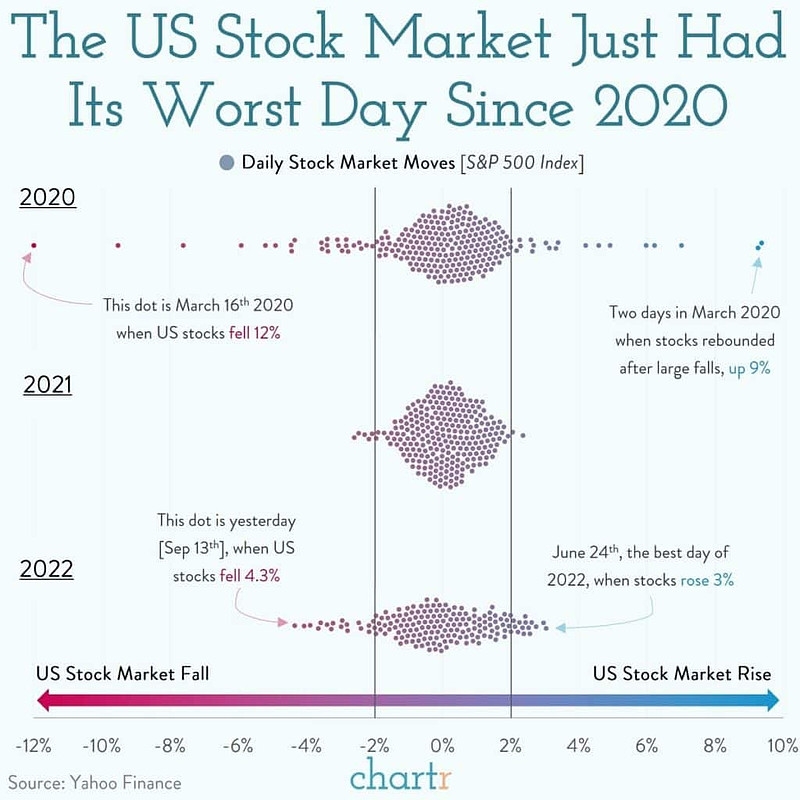

In recent years, Samsung has experienced mixed stock performance. While the company has delivered strong financial results, the stock has faced downward pressure due to concerns about global economic conditions and increased competition.

For example, in 2021, Samsung's stock price surged to record highs, driven by strong demand for its smartphones and semiconductors. However, in 2022, the stock experienced a significant decline due to global supply chain disruptions and concerns about economic growth.

Conclusion

In conclusion, U.S. investors can buy Samsung stock by opening an international trading account and going through a brokerage that offers access to the KRX. While there are risks involved, investing in Samsung offers potential benefits, including strong financial performance and a competitive market position. As with any investment, it's crucial to do thorough research and understand the risks before making a decision.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....