In the ever-evolving world of finance, the stock market is a key indicator of economic health and investor sentiment. As we approach 2026, it's crucial to take a closer look at the US stock market outlook to understand potential trends, risks, and opportunities. This article delves into a comprehensive analysis of the US stock market, offering predictions and insights for the upcoming year.

Economic Outlook and Market Trends

The economic landscape plays a significant role in shaping the stock market. As we head into 2026, several key factors are likely to influence the US stock market:

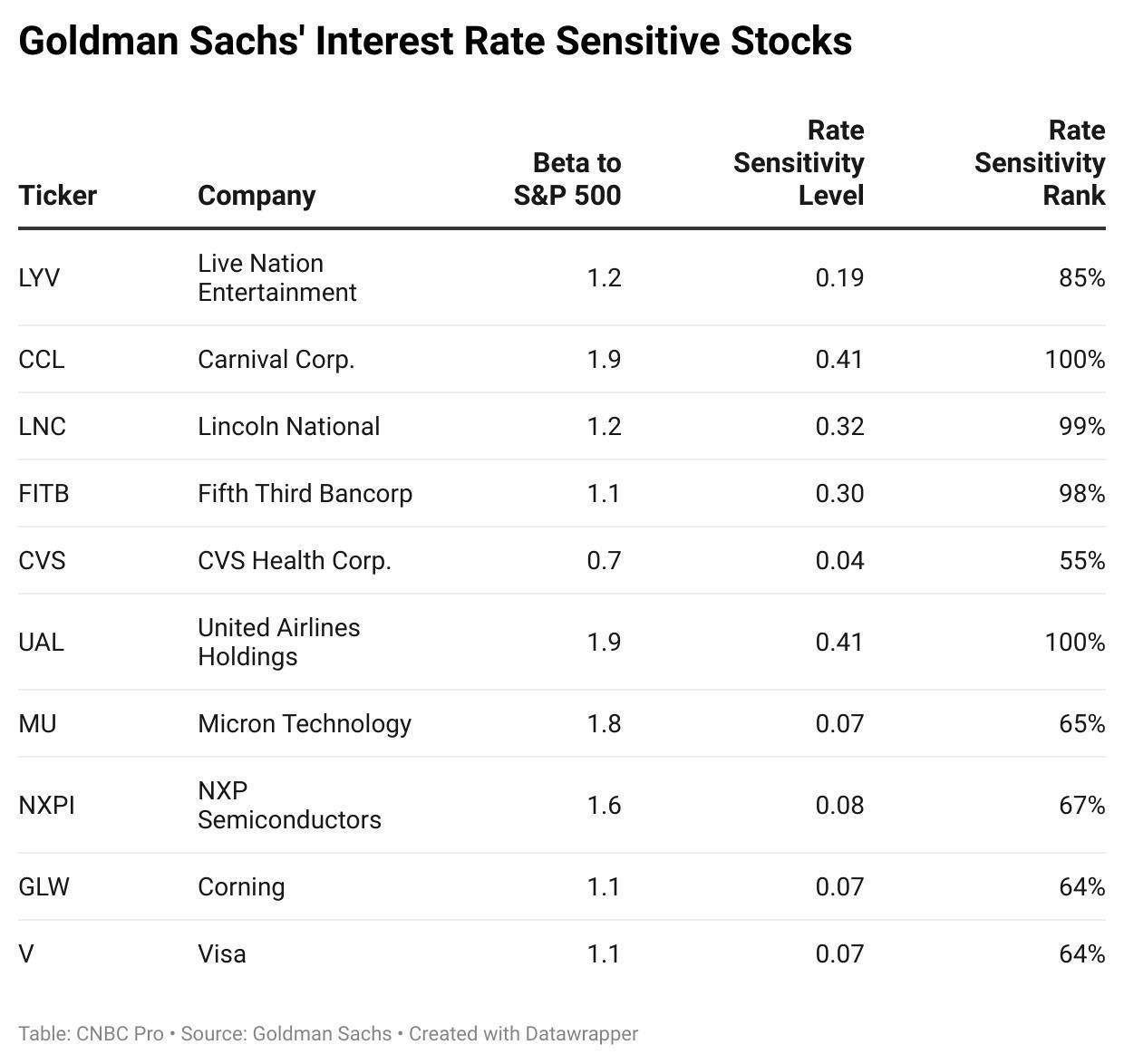

- Inflation and Interest Rates: The Federal Reserve's monetary policy, particularly inflation and interest rate decisions, will have a profound impact on the stock market. Lower inflation and interest rates could boost investor confidence and drive stock prices higher.

- Corporate Earnings: The performance of publicly-traded companies is a critical driver of the stock market. As corporate earnings continue to grow, it's likely that stock prices will follow suit.

- Technological Advancements: Emerging technologies and innovative industries are expected to play a significant role in the stock market. Companies at the forefront of these advancements are likely to see substantial growth.

Sector Outlook

Different sectors within the stock market are expected to perform differently in 2026. Here's a breakdown of some key sectors:

- Technology: The technology sector is likely to remain a major driver of the stock market. Artificial intelligence, blockchain, and cloud computing are expected to be key growth areas.

- Healthcare: The healthcare sector is poised for significant growth, driven by an aging population and the increasing demand for medical services and technology.

- Energy: The energy sector could see a rebound, particularly in renewable energy and green technologies.

Stock Market Predictions

Based on the economic outlook and sector trends, here are some predictions for the US stock market in 2026:

- Overall Market Growth: The US stock market is expected to experience modest growth in 2026, with a potential for robust returns in certain sectors.

- Volatility: The stock market is likely to remain volatile, with periods of significant ups and downs.

- Diversification: Diversifying your investment portfolio across various sectors and asset classes is crucial to mitigate risk.

Case Study: Tesla, Inc.

To illustrate the potential of the stock market, let's consider the case of Tesla, Inc. (TSLA). As a leader in electric vehicles and renewable energy, Tesla has seen significant growth in recent years. With the continued rise of electric vehicles and the push for green technologies, Tesla is likely to remain a key player in the stock market.

Conclusion

The 2026 US stock market outlook is shaped by a complex interplay of economic factors, sector trends, and technological advancements. By understanding these dynamics, investors can make informed decisions and position themselves for potential growth. As always, it's crucial to stay informed and remain flexible in your investment strategy.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....