The year 2021 witnessed a tumultuous period in the US stock market, marked by a dramatic collapse that sent shockwaves through the financial community. This article delves into the causes, effects, and lessons learned from the 2021 US stock market collapse, providing readers with a comprehensive understanding of this critical event.

Causes of the Stock Market Collapse

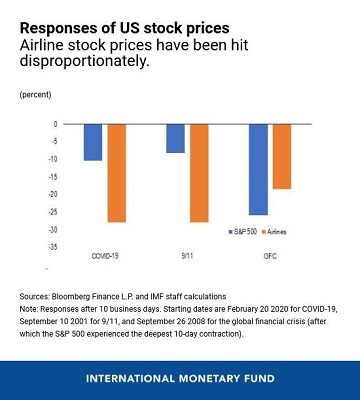

Several factors contributed to the stock market collapse in 2021. One of the primary causes was the rapid rise in inflation, which eroded the purchasing power of investors. The Federal Reserve's attempt to control inflation by raising interest rates further exacerbated the situation. Additionally, the ongoing COVID-19 pandemic and its economic impact continued to cast a shadow over the market, leading to uncertainty and volatility.

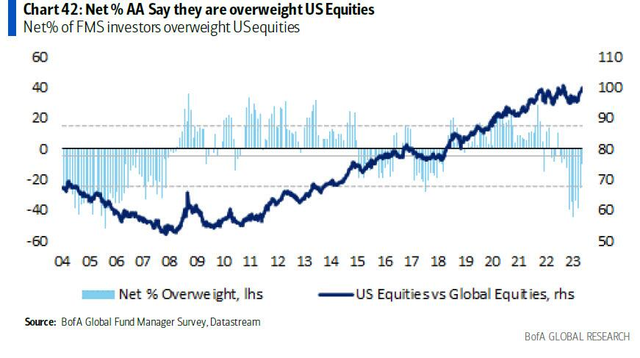

Impact on Investors

The stock market collapse had a significant impact on investors. Many individuals and institutions experienced substantial losses, prompting concerns about the future of their investments. This collapse also led to a rise in market volatility, making it challenging for investors to predict market trends and make informed decisions.

Key Events Leading to the Collapse

Several key events played a role in the 2021 stock market collapse. One of the most notable events was the sudden surge in the price of cryptocurrencies, which attracted significant attention and investment from both retail and institutional investors. However, the subsequent collapse of the cryptocurrency market sent shockwaves through the stock market, leading to widespread panic and sell-offs.

Another crucial event was the increase in corporate earnings reports, which revealed that many companies were struggling to maintain profitability due to the economic uncertainty caused by the pandemic. This news led to a significant drop in stock prices, as investors became increasingly wary of the market's future prospects.

Lessons Learned

The 2021 US stock market collapse offers several lessons for investors and policymakers. Firstly, it underscores the importance of diversifying investment portfolios to mitigate risks. Secondly, it highlights the need for investors to stay informed and adapt to changing market conditions. Lastly, the collapse serves as a reminder of the importance of regulatory oversight to prevent excessive speculation and volatility.

Case Studies

Several high-profile cases illustrate the impact of the 2021 stock market collapse. One such case is the collapse of GameStop (GME), a retail video game company that became a symbol of the market's volatility. The stock soared in value after a group of retail investors banded together on online forums to drive up the price, leading to a dramatic reversal of fortune when the stock collapsed.

Another notable case is the collapse of AMC Theatres, a movie theater chain that experienced a significant drop in revenue due to the COVID-19 pandemic. The stock collapsed as investors grew concerned about the company's future prospects, despite efforts to restructure and adapt to the changing landscape.

Conclusion

The 2021 US stock market collapse was a complex event with multiple contributing factors. Understanding the causes, effects, and lessons learned from this event is crucial for investors and policymakers alike. By taking these lessons to heart, we can better navigate future market challenges and mitigate risks.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....