In the global financial landscape, the stock markets of China and the United States have long been points of interest for investors worldwide. The rivalry between these two markets, each with its unique characteristics and strengths, is a topic of much debate. This article aims to provide a comprehensive analysis of the China and US stock markets, highlighting key differences, growth potential, and investment strategies.

Understanding the China Stock Market

The Chinese stock market, known as the Shanghai Stock Exchange (SSE) and the Shenzhen Stock Exchange (SZSE), has been experiencing significant growth over the past few decades. Driven by the country's rapid economic development, the Chinese stock market offers a diverse range of sectors, including technology, consumer goods, and energy.

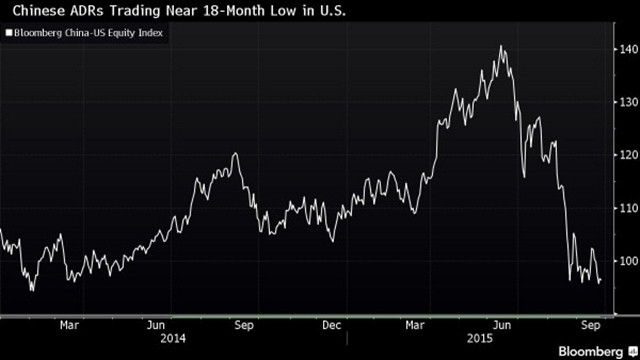

One notable feature of the Chinese stock market is the heavy influence of government policies. The government plays a significant role in shaping market trends and has implemented various policies to support growth and stability. Additionally, the Chinese stock market is known for its high volatility, with market movements often being influenced by regulatory changes and macroeconomic factors.

Key Characteristics of the Chinese Stock Market:

- Government Influence: Government policies can significantly impact market dynamics.

- Volatility: High volatility can present both opportunities and risks.

- Sector Diversification: A wide range of sectors, including technology and consumer goods.

Understanding the US Stock Market

The US stock market, dominated by the New York Stock Exchange (NYSE) and the NASDAQ, is considered one of the most mature and sophisticated in the world. It is known for its high level of liquidity, transparency, and regulatory framework.

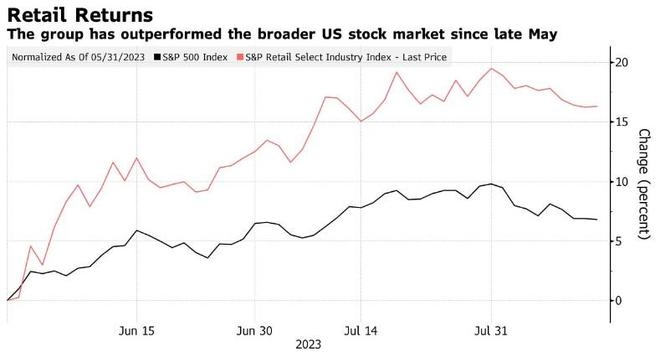

The US stock market is home to some of the largest and most successful companies globally, including tech giants like Apple, Microsoft, and Amazon. It also offers a wide range of investment options, from individual stocks and bonds to mutual funds and exchange-traded funds (ETFs).

Key Characteristics of the US Stock Market:

- High Liquidity: Easy to trade, with high levels of liquidity.

- Transparency: A well-regulated market with high transparency.

- Diverse Investment Options: Offers a wide range of investment choices.

Comparing Growth Potential

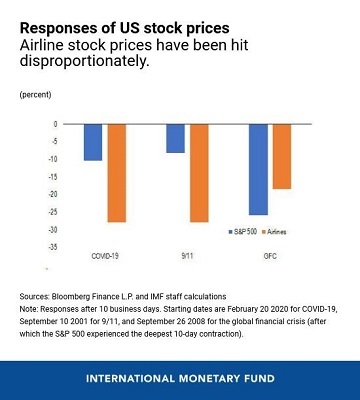

When comparing the growth potential of the China and US stock markets, several factors come into play. While the Chinese market has experienced significant growth, it also faces challenges such as regulatory changes and economic uncertainties.

On the other hand, the US stock market has a well-established infrastructure and a diverse range of companies, which provides a stable and attractive investment environment.

Growth Potential Factors:

- Economic Stability: The US market benefits from economic stability, while the Chinese market is subject to more volatility.

- Regulatory Environment: The US market is well-regulated, while the Chinese market is influenced by government policies.

- Diversification: The US market offers greater diversification, with a wide range of investment options.

Investment Strategies

For investors considering investment in either the China or US stock market, it is crucial to develop a well-informed strategy. This involves understanding the unique characteristics of each market and aligning investment decisions with long-term goals.

Investment Strategy Tips:

- Research and Analysis: Conduct thorough research and analysis before investing.

- Diversification: Diversify your portfolio to mitigate risks.

- Long-term Perspective: Consider a long-term perspective to benefit from market growth.

Case Studies

To illustrate the differences between the China and US stock markets, let's consider two companies: Tencent, a major player in the Chinese technology sector, and Apple, a leading company in the US tech industry.

Tencent: As one of the largest tech companies in China, Tencent has seen significant growth in recent years. However, the company's performance is heavily influenced by government policies and market trends.

Apple: Apple, on the other hand, has a strong presence in the global market and benefits from its diverse product range and loyal customer base. The company's performance is generally less affected by regulatory changes and economic fluctuations.

In conclusion, the China and US stock markets offer unique opportunities and challenges for investors. Understanding the characteristics of each market and developing a well-informed investment strategy is key to capitalizing on these opportunities.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....