The US stock market value is a critical indicator of the financial health and economic strength of the United States. It reflects the collective worth of all publicly traded companies listed on American stock exchanges. This article delves into the intricacies of the US stock market value, exploring its components, historical trends, and its significance in the global financial landscape.

Components of the US Stock Market Value

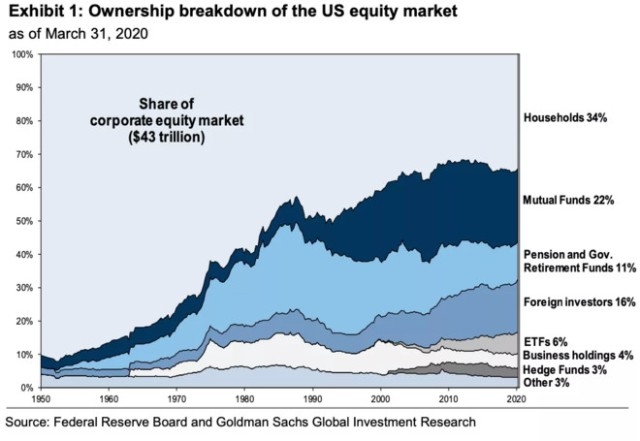

The US stock market value is primarily derived from the total market capitalization of all listed companies. Market capitalization is calculated by multiplying the number of outstanding shares of a company by its current stock price. This figure provides a snapshot of the overall size and economic influence of the stock market.

Historical Trends

Over the past century, the US stock market value has experienced significant fluctuations. The Great Depression of the 1930s saw a dramatic decline in market value, followed by a robust recovery. The 1980s and 1990s witnessed a period of unprecedented growth, with the dot-com bubble and the tech revolution driving market capitalization to new heights. The 2008 financial crisis, however, resulted in a sharp decline, followed by a gradual recovery.

Significance of the US Stock Market Value

The US stock market value plays a crucial role in the global financial system. It serves as a barometer of economic health, reflecting investor confidence and market sentiment. A strong stock market value can attract foreign investment, stimulate economic growth, and create job opportunities. Conversely, a weak market value can have adverse effects on the economy, leading to reduced investment and job losses.

Key Factors Influencing the US Stock Market Value

Several factors influence the US stock market value. These include:

- Economic indicators: Data such as GDP growth, unemployment rates, and inflation rates can impact investor confidence and market performance.

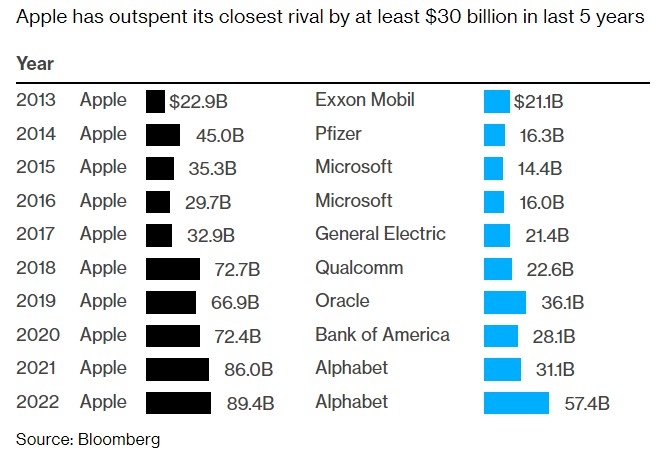

- Corporate earnings: The financial performance of companies listed on the stock market is a key driver of market value.

- Political events: Changes in government policies, regulatory reforms, and international relations can affect market sentiment.

- Technological advancements: Innovations and technological breakthroughs can drive market growth and create new investment opportunities.

Case Studies

To illustrate the impact of these factors, consider the following case studies:

- Tech Bubble of 2000: The dot-com bubble, driven by the rapid growth of technology companies, led to a significant increase in the US stock market value. However, the bubble burst in 2000, resulting in a sharp decline in market value.

- Financial Crisis of 2008: The 2008 financial crisis, triggered by the collapse of the housing market, caused a substantial drop in the US stock market value. The subsequent recovery was gradual, with the market value eventually surpassing pre-crisis levels.

Conclusion

The US stock market value is a vital indicator of the financial health and economic strength of the United States. Understanding its components, historical trends, and key influencing factors is essential for investors and policymakers alike. By analyzing the US stock market value, one can gain valuable insights into the economic landscape and make informed decisions regarding investments and economic policies.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....