In the ever-evolving world of financial markets, having the right tools for analysis is crucial. One such tool that has gained significant traction is Anaplan, a powerful cloud-based platform designed for business planning and modeling. This article delves into how Anaplan can revolutionize the analysis of US stocks, offering insights into its features, benefits, and real-world applications.

Understanding Anaplan

Anaplan is a comprehensive platform that allows businesses to create detailed models and forecasts. Its unique approach to collaborative planning enables teams to work together seamlessly, ensuring accurate and timely decision-making. When it comes to analyzing US stocks, Anaplan's capabilities are particularly valuable.

Key Features of Anaplan for US Stocks Analysis

Advanced Modeling Capabilities: Anaplan allows users to create complex models that can analyze various aspects of the stock market, including price trends, market capitalization, and sector performance. This enables investors to gain a deeper understanding of the market dynamics.

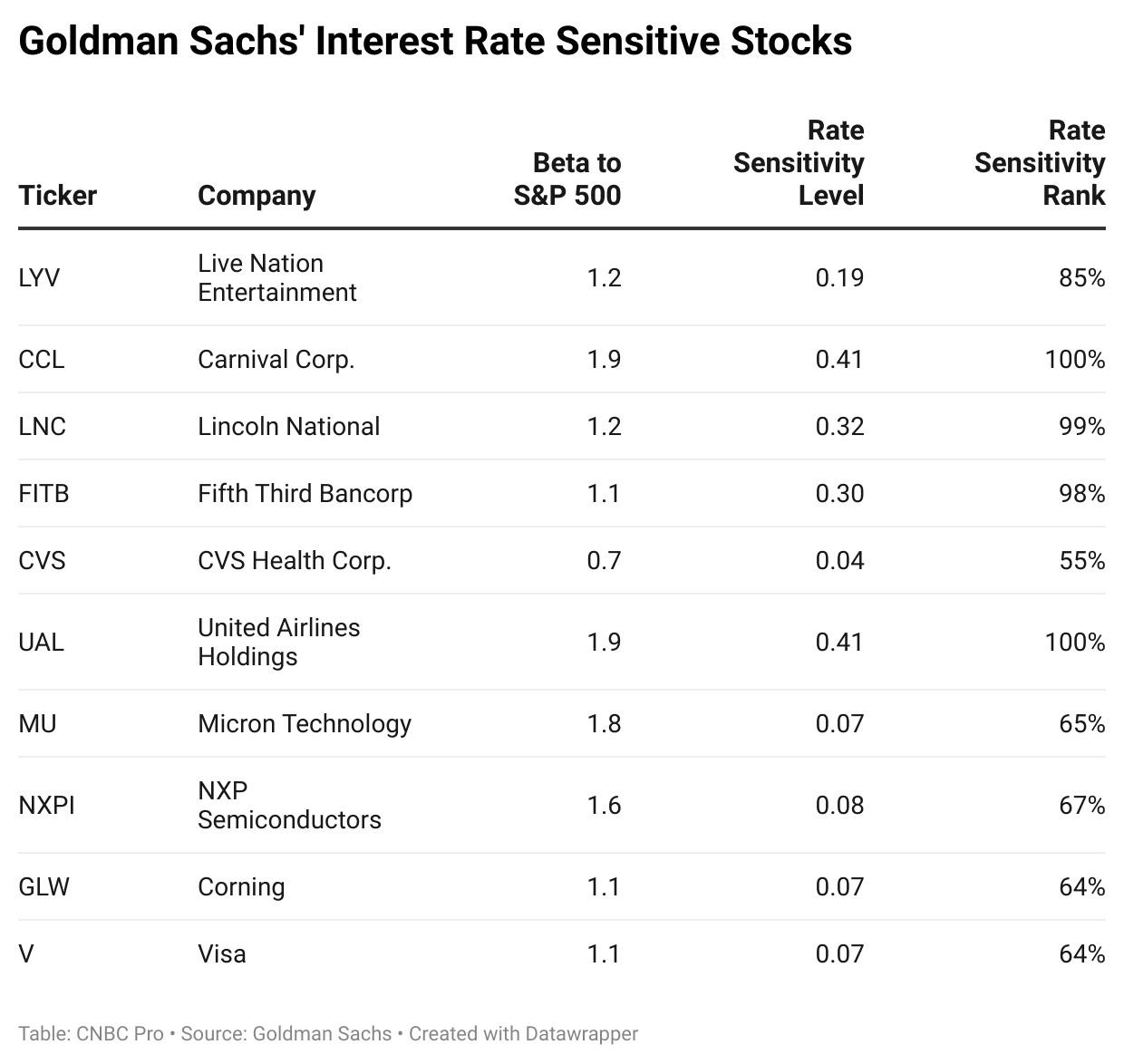

Scenario Planning: One of Anaplan's standout features is its ability to perform scenario planning. This means users can create multiple scenarios based on different assumptions, such as changes in interest rates or economic conditions, and see how these changes might impact the stock market.

Collaborative Planning: Anaplan's collaborative nature is perfect for team-based stock analysis. Multiple team members can contribute their insights, ensuring a comprehensive and well-rounded analysis.

Integration with External Data: Anaplan can integrate with various external data sources, providing users with access to a wealth of information. This includes financial data, economic indicators, and market trends, all of which are essential for accurate stock analysis.

Real-World Applications of Anaplan in US Stocks Analysis

Portfolio Optimization: Anaplan can help investors optimize their portfolios by analyzing various stocks and sectors. By considering factors like risk, return, and market trends, investors can make informed decisions about where to allocate their investments.

Market Forecasting: Anaplan's scenario planning capabilities make it an excellent tool for forecasting market trends. By analyzing different scenarios, investors can gain insights into potential market movements and adjust their strategies accordingly.

Risk Management: Anaplan's ability to model complex scenarios is particularly useful for risk management. By identifying potential risks and their impact on the stock market, investors can take proactive measures to mitigate these risks.

Case Study: Anaplan in a Large Investment Firm

A large investment firm used Anaplan to analyze the performance of various US stocks. By leveraging Anaplan's advanced modeling capabilities and collaborative features, the firm was able to identify promising investment opportunities and mitigate potential risks. This resulted in improved portfolio performance and a more informed decision-making process.

Conclusion

Anaplan is a powerful tool for analyzing US stocks, offering a range of features that can help investors gain a deeper understanding of the market. Its advanced modeling capabilities, collaborative nature, and integration with external data make it an invaluable asset for anyone looking to improve their stock analysis. As the financial market continues to evolve, tools like Anaplan will play a crucial role in helping investors stay ahead of the curve.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....