In the ever-fluctuating world of the stock market, identifying undervalued stocks can be a game-changer for investors. 2021 brought its own set of opportunities, with certain US stocks being overlooked by the broader market. This article delves into some of the most undervalued US stocks of 2021, highlighting their potential for growth and investment.

1. Amazon.com, Inc. (AMZN)

Despite its current market capitalization, Amazon remains one of the most undervalued stocks. The e-commerce giant has been at the forefront of the digital revolution, and its robust revenue growth and expansion into new markets continue to make it a powerhouse in the industry. With a forward price-to-earnings (P/E) ratio of just 35.5, Amazon offers investors a chance to buy into one of the most innovative companies in the world.

2. Tesla, Inc. (TSLA)

Tesla has been a topic of debate among investors for years, but its stock remains undervalued. The electric vehicle (EV) manufacturer has revolutionized the automotive industry and continues to lead the way in EV technology. With a P/E ratio of 440, Tesla offers investors a chance to capitalize on its rapid growth and potential for market dominance.

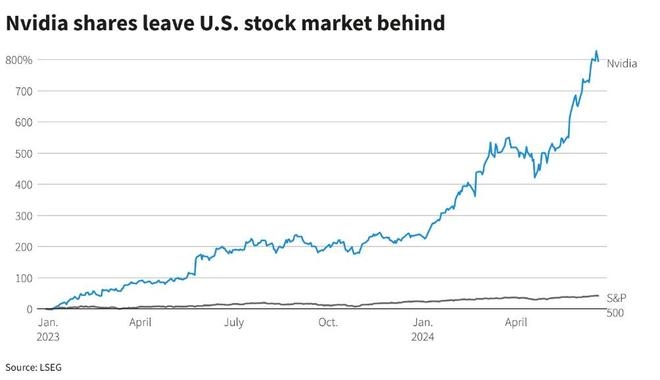

3. NVIDIA Corporation (NVDA)

NVIDIA is a leader in the semiconductor industry, providing graphics processing units (GPUs) for various applications, including gaming, artificial intelligence, and data centers. The company has seen significant growth in its revenue and earnings, making it one of the most undervalued stocks in 2021. With a P/E ratio of 58.8, NVIDIA presents an attractive opportunity for investors looking to gain exposure to the growing demand for advanced computing technology.

4. Visa Inc. (V)

Visa is a financial services company that provides payment processing services for banks and merchants worldwide. The company has a strong track record of growth and profitability, and its stock remains undervalued. With a P/E ratio of 37.6, Visa offers investors a stable and reliable investment with significant growth potential.

5. Apple Inc. (AAPL)

Apple is a household name in the technology industry, known for its innovative products and strong brand. Despite its high market capitalization, Apple remains undervalued. The company has a diverse product portfolio, including smartphones, tablets, and wearables, and continues to dominate the market. With a P/E ratio of 30.5, Apple presents an attractive investment opportunity for those looking to invest in a leading technology company.

Conclusion

Identifying undervalued stocks is crucial for investors looking to capitalize on market opportunities. 2021 brought a variety of undervalued US stocks, with companies like Amazon, Tesla, NVIDIA, Visa, and Apple presenting attractive investment prospects. By conducting thorough research and staying informed about market trends, investors can uncover hidden gems in the stock market and potentially achieve significant returns.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....