In the vast world of finance, the United States Stock Exchange is a cornerstone of global markets. It's home to numerous indexes that track the performance of various sectors and the overall market. Understanding these indexes is crucial for investors looking to make informed decisions. This article delves into the names of some of the most prominent US stock exchange indexes, explaining their significance and how they influence investment strategies.

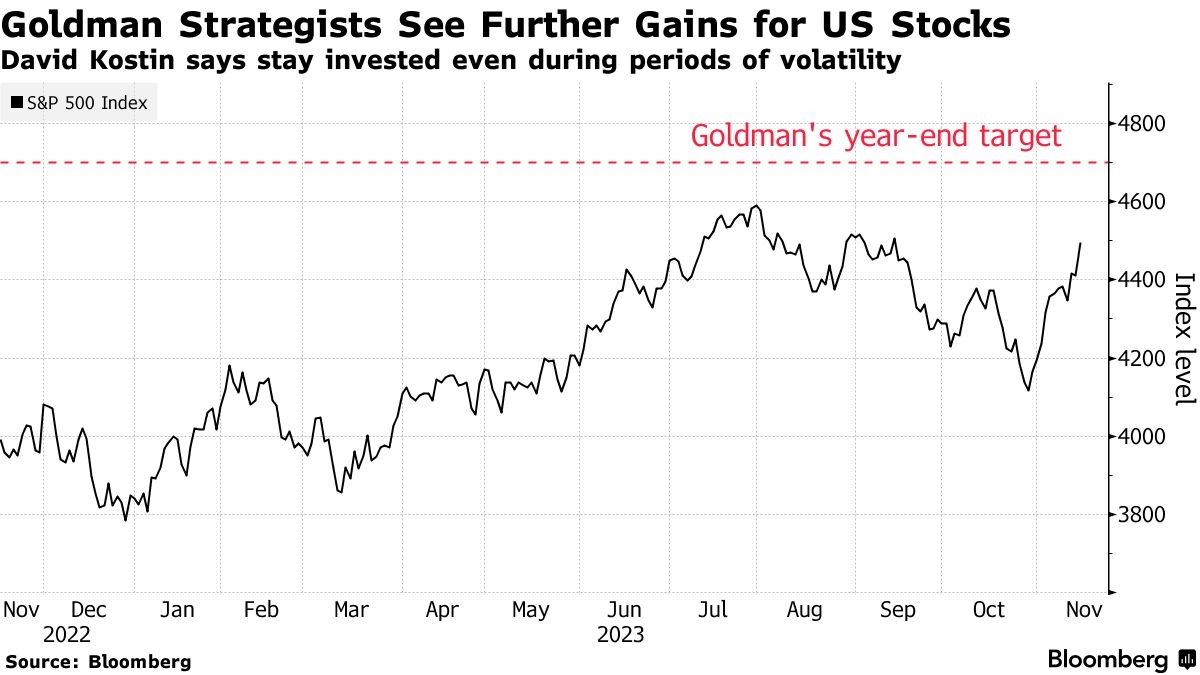

The S&P 500

The S&P 500 is perhaps the most well-known index in the US. It tracks the performance of 500 large companies listed on the stock exchanges in the United States. This index represents about 80% of the total market capitalization of all publicly traded companies in the United States. The S&P 500 is often used as a benchmark for the overall health of the US stock market.

The Dow Jones Industrial Average (DJIA)

The Dow Jones Industrial Average (DJIA) is another highly regarded index. It consists of 30 large, publicly-owned companies and is often seen as a proxy for the overall US stock market. The DJIA has been around since 1896 and is one of the oldest and most widely followed stock market indexes in the world.

The NASDAQ Composite

The NASDAQ Composite is an index that tracks all stocks listed on the NASDAQ stock exchange. It includes more than 3,200 companies and is known for its high-tech focus. The NASDAQ Composite is a good indicator of the performance of the technology sector, which has been a significant driver of the US economy in recent years.

The Russell 3000

The Russell 3000 is an index that represents the largest 3,000 U.S. companies, based on their market capitalization. It includes the Russell 1000, which represents the largest 1,000 companies, and the Russell 2000, which represents the smallest 2,000 companies. The Russell 3000 is often used as a benchmark for the broad US stock market.

The Wilshire 5000 Total Market Index

The Wilshire 5000 Total Market Index is a broad-based index that tracks the performance of all U.S. equity securities with readily available price data. It includes nearly all U.S. stocks and represents the entire investable U.S. equity market. The Wilshire 5000 is a useful tool for investors looking to gain exposure to the broad market.

Conclusion

Understanding the names and functions of US stock exchange indexes is essential for investors. Each index serves a unique purpose and can provide valuable insights into the market. By familiarizing yourself with these indexes, you can make more informed investment decisions and better understand the market's dynamics.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....