The S&P 500 index, a key benchmark for the U.S. stock market, has been a subject of intense analysis and speculation. As we delve into the new year, it's crucial to understand the projections for the S&P 500 and what they mean for investors. In this article, we'll explore the 2023 outlook for the S&P 500 and provide insights into potential trends and predictions.

Understanding the S&P 500

The S&P 500 is a widely followed index that tracks the performance of 500 large companies listed on U.S. exchanges. These companies represent a diverse range of industries and are considered to be representative of the overall U.S. stock market. The index has been a reliable indicator of market trends and investor sentiment over the years.

2023 Outlook: A Mixed Bag

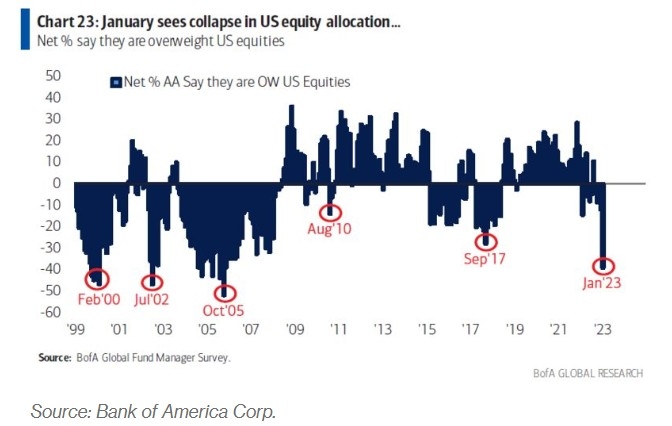

The outlook for the S&P 500 in 2023 is a mixed bag. While there are signs of optimism, there are also potential risks and uncertainties that could impact the market.

Positive Factors:

- Economic Growth: The U.S. economy is expected to grow modestly in 2023, driven by factors such as low unemployment and rising wages.

- Corporate Earnings: Companies in the S&P 500 are expected to see strong earnings growth, particularly in sectors such as technology and healthcare.

- Low Interest Rates: The Federal Reserve has signaled that interest rates will remain low in 2023, which could boost stock prices.

Negative Factors:

- Inflation: Inflation remains a concern, with the Consumer Price Index (CPI) rising above 5% in some months. This could lead to higher borrowing costs and reduced consumer spending.

- Global Economic Uncertainty: The global economy is facing challenges, including the impact of the COVID-19 pandemic and geopolitical tensions.

- Market Valuations: The S&P 500 is currently trading at higher valuations compared to historical averages, which could lead to a market correction.

Predictions for the S&P 500 in 2023

Several experts have made predictions for the S&P 500 in 2023. Here are some of the key projections:

- Consensus Forecast: The consensus forecast for the S&P 500 in 2023 is around 4,300-4,400 points.

- Bullish Outlook: Some experts believe the S&P 500 could reach 4,500-4,600 points, driven by strong corporate earnings and economic growth.

- Bearish Outlook: Others are more cautious and predict a range of 4,000-4,200 points, due to potential risks such as inflation and market valuations.

Case Studies:

To provide a clearer picture of the potential outlook for the S&P 500, let's consider two case studies:

Technology Sector: The technology sector has been a major driver of growth in the S&P 500. Companies like Apple and Microsoft are expected to continue delivering strong earnings in 2023. However, rising inflation and concerns about cybersecurity could pose challenges.

Healthcare Sector: The healthcare sector is another key component of the S&P 500. With an aging population and increasing healthcare costs, companies like Johnson & Johnson and Pfizer are expected to see strong growth. However, regulatory changes and competition could impact these companies' performance.

Conclusion

The outlook for the S&P 500 in 2023 is a complex mix of potential opportunities and risks. While there are positive factors to consider, investors should also be aware of the potential challenges ahead. As always, it's important to do your own research and consult with a financial advisor before making investment decisions.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....