As we approach the latter half of 2025, investors are keen to understand the outlook for the US stock market. The market has been through a tumultuous few years, with numerous challenges and uncertainties. However, the outlook for July 2025 seems to be cautiously optimistic. In this article, we will explore the key factors that could influence the US stock market in the coming months.

Economic Growth and Inflation

The first and foremost factor that affects the stock market is the economic outlook. As of now, the US economy is expected to grow moderately in 2025. The Federal Reserve has been cautious in its approach to monetary policy, aiming to balance inflation and economic growth. If the Fed continues to manage inflation effectively, it could lead to a more stable stock market environment.

Corporate Earnings

Another crucial factor is corporate earnings. In the past few years, companies have shown resilience in the face of economic challenges. If this trend continues, it could boost investor confidence and lead to higher stock prices. Companies in sectors like technology, healthcare, and consumer discretionary are expected to perform well in 2025.

Market Valuations

Market valuations play a significant role in determining the stock market's direction. As of now, the US stock market is trading at reasonable valuations. However, if valuations become overextended, it could lead to a market correction. Investors should keep an eye on valuation metrics like the price-to-earnings (P/E) ratio and the price-to-book (P/B) ratio.

Technological Advancements

Technological advancements continue to drive innovation and growth in the stock market. Companies like Apple, Google, and Microsoft are leading the charge in this area. As these companies continue to innovate, they are likely to create new opportunities for investors.

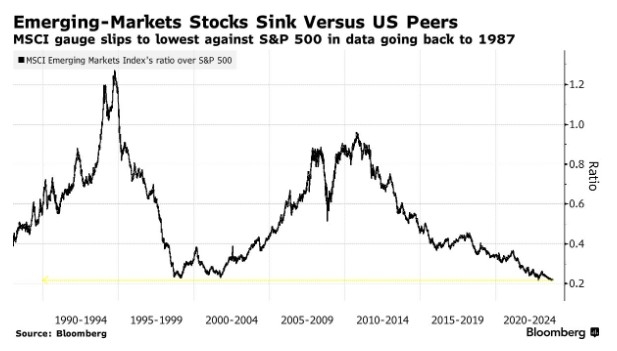

International Factors

International factors, such as global trade tensions and geopolitical events, can also impact the US stock market. In the coming months, investors should keep an eye on developments in Europe, Asia, and other regions. A stable global environment could be beneficial for the US stock market.

Case Studies

To illustrate the potential impact of these factors, let's consider a few case studies:

- Apple Inc.: As a leading technology company, Apple has been a significant driver of growth in the US stock market. In 2025, if Apple continues to innovate and expand its product line, it could lead to higher stock prices.

- Tesla Inc.: Tesla has been a standout performer in the electric vehicle (EV) space. If the company manages to scale up production and achieve profitability, it could attract more investors and drive stock prices higher.

- Johnson & Johnson: As a leading healthcare company, Johnson & Johnson has been resilient in the face of economic challenges. If the company continues to invest in research and development, it could lead to new drug approvals and higher stock prices.

Conclusion

In conclusion, the outlook for the US stock market in July 2025 seems cautiously optimistic. While there are challenges and uncertainties, the market is expected to grow moderately. Investors should focus on factors like economic growth, corporate earnings, market valuations, technological advancements, and international factors. By staying informed and making informed decisions, investors can navigate the market and potentially achieve their investment goals.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....