In recent weeks, global stock markets have experienced a significant downturn, primarily driven by fears of impending US tariffs. These tariffs, which are set to impact a wide range of goods and services, have sent shockwaves through the financial markets, raising concerns about economic stability and growth. This article delves into the reasons behind the market tumble and explores the potential implications for the global economy.

The Rising Fear of Tariffs

The fear of US tariffs has been a major driver of the recent market downturn. The Trump administration's decision to impose tariffs on a wide range of goods, including steel and aluminum, has sparked concerns about potential trade wars and their impact on global economic stability. The fear of higher costs and reduced demand for goods has led to a sell-off in many sectors, particularly those heavily reliant on international trade.

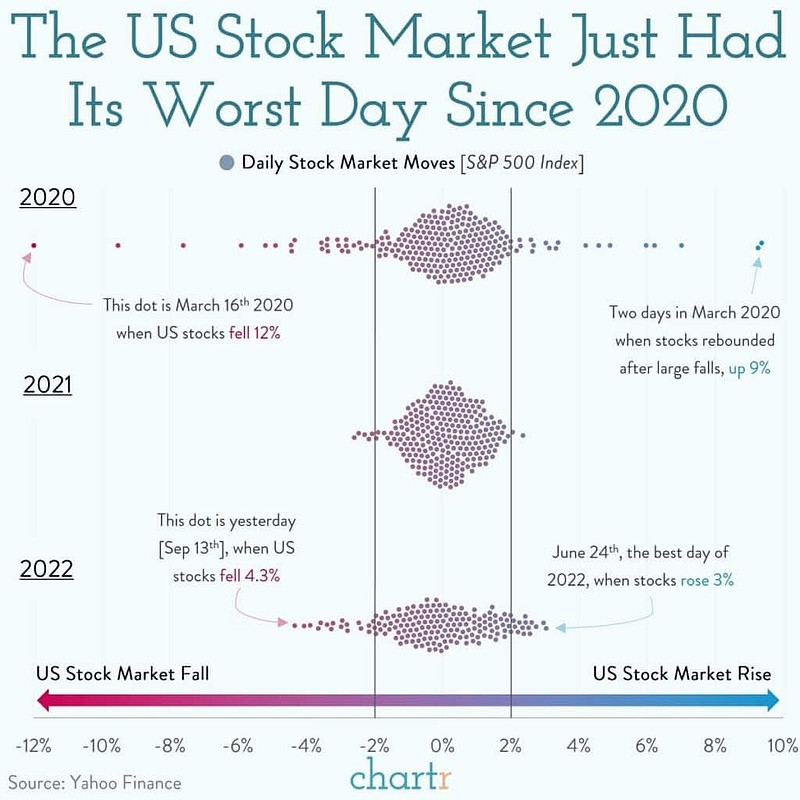

Impact on Global Stock Markets

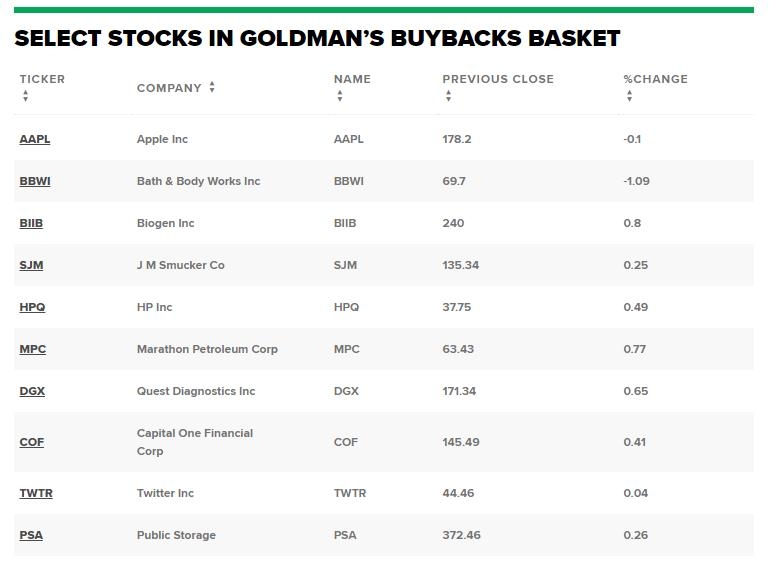

The impact of the US tariffs on global stock markets has been profound. Many major indices, including the S&P 500 and the Dow Jones Industrial Average, have experienced significant declines. The technology sector, which is heavily reliant on international trade, has been particularly hard hit, with major companies like Apple and Microsoft seeing their stock prices fall sharply.

Reasons for the Market Tumble

There are several key reasons why the fear of US tariffs has led to a market tumble:

- Increased Costs: Tariffs can lead to higher costs for businesses, which can reduce their profitability and lead to lower stock prices.

- Reduced Demand: Higher prices for goods can lead to reduced demand, which can further impact business revenues and stock prices.

- Uncertainty: The uncertainty surrounding the potential for trade wars and their impact on the global economy has created a negative sentiment in the markets.

- Weakening Dollar: The US dollar has weakened in recent weeks, which has made US exports more expensive and could further impact the global economy.

Case Studies

To illustrate the impact of US tariffs on global stock markets, let's consider a few case studies:

- Steel Tariffs: The imposition of steel tariffs by the US has led to increased steel prices worldwide. This has impacted companies in the construction and manufacturing sectors, which rely heavily on steel.

- Technology Sector: The technology sector has been particularly vulnerable to the impact of US tariffs. Companies like Apple and Microsoft, which rely on international trade for a significant portion of their revenue, have seen their stock prices fall sharply in recent weeks.

Conclusion

The fear of US tariffs has sent shockwaves through global stock markets, leading to a significant downturn. While the full impact of these tariffs is yet to be seen, it is clear that they have raised concerns about economic stability and growth. As the situation unfolds, it will be important to monitor the impact of these tariffs on the global economy and the stock markets.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....