The United States stock market has long been a symbol of economic power and financial growth. As of the latest data, the current total US stock market value has reached an impressive figure, reflecting the robustness and dynamism of the American economy. In this article, we will delve into the key factors influencing this value, analyze its impact on the global economy, and explore the potential risks and opportunities it presents.

Historical Growth and Current Trends

Over the past few decades, the US stock market has experienced significant growth, with its value skyrocketing. Historical data reveals that the total US stock market value has increased from around

Key Influencing Factors

Several key factors have contributed to the current total US stock market value. Here are some of the most notable ones:

- Economic Growth: A strong economy, characterized by low unemployment rates and stable inflation, has been a major driver of stock market growth. As companies generate higher profits, their stock prices tend to rise.

- Technological Advancements: The rise of technology has revolutionized various industries, creating new opportunities for growth and innovation. This has, in turn, boosted the stock market value of technology companies.

- Globalization: Increased globalization has opened up new markets for companies, allowing them to expand their operations and increase their profits. This has contributed to the overall growth of the stock market.

- Regulatory Environment: A favorable regulatory environment has encouraged investment and innovation, fostering the growth of the stock market.

Impact on the Global Economy

The current total US stock market value has a significant impact on the global economy. As the largest stock market in the world, it sets a benchmark for other markets and influences investor sentiment worldwide. Here are some key impacts:

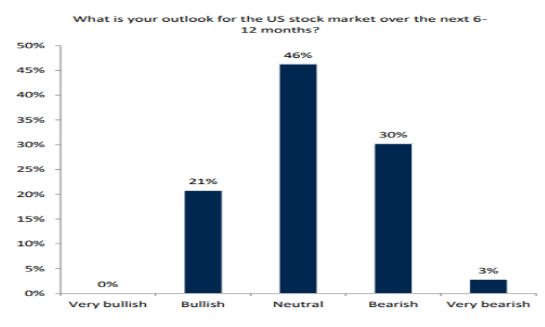

- Investor Sentiment: The performance of the US stock market often serves as a gauge for investor sentiment, influencing investment decisions in other markets.

- Currency Fluctuations: The value of the US dollar is often influenced by the performance of the stock market, impacting currency exchange rates.

- Global Growth: A strong US stock market can boost global economic growth, as companies expand their operations internationally.

Risks and Opportunities

While the current total US stock market value presents numerous opportunities, it also comes with its own set of risks. Here are some key considerations:

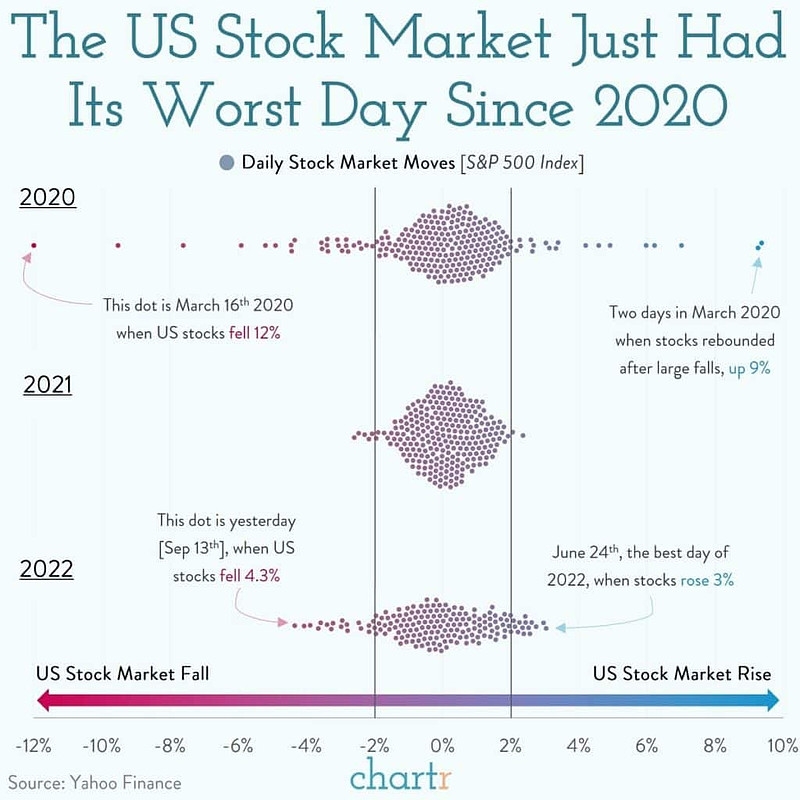

- Market Volatility: The stock market is inherently volatile, and unexpected events can lead to significant price fluctuations.

- Economic Uncertainty: Economic downturns, such as the recent COVID-19 pandemic, can impact the stock market value.

- Technological Disruption: Rapid technological advancements can disrupt traditional industries, impacting stock market values.

Despite these risks, the current total US stock market value presents numerous opportunities for investors. By understanding the key factors influencing this value and staying informed about market trends, investors can make informed decisions and capitalize on potential opportunities.

Conclusion

The current total US stock market value reflects the economic power and dynamism of the United States. By understanding the key factors influencing this value and staying informed about market trends, investors can make informed decisions and capitalize on potential opportunities. As the market continues to evolve, it will be crucial to stay vigilant and adapt to changing conditions.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....