As we approach the final quarter of 2025, investors are keen to understand the outlook for the US large cap stock market. Large cap stocks, representing the top companies in terms of market capitalization, often serve as a bellwether for the broader market. This article delves into the current market trends, potential risks, and opportunities for investors looking to invest in these blue-chip companies.

Market Trends and Performance

In the first half of 2025, the US large cap stock market has been marked by a mix of growth and volatility. The S&P 500, which tracks the performance of the largest companies in the US, has seen a steady rise, driven by strong earnings reports and positive economic indicators. However, the market has also been sensitive to geopolitical tensions, rising interest rates, and inflation concerns, leading to periods of uncertainty.

Geopolitical Tensions and Geopolitical Risks

The ongoing geopolitical tensions, particularly those involving major economies such as China and Russia, remain a key concern for investors. These tensions could potentially disrupt global supply chains and lead to increased inflation, which could negatively impact the profitability of large cap companies.

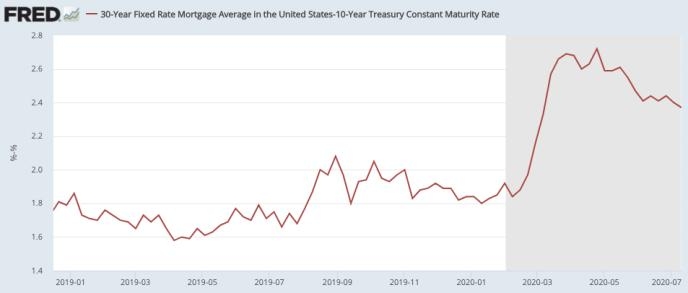

Rising Interest Rates and Inflation Concerns

Another significant factor affecting the large cap stock market is the rising interest rates and inflation concerns. The Federal Reserve's aggressive stance on monetary policy to control inflation has led to higher borrowing costs for companies, which could squeeze their profit margins. However, some large cap companies with strong balance sheets and diversified revenue streams may be able to mitigate the impact of higher interest rates.

Opportunities in Tech and Healthcare

Despite the challenges, there are several opportunities in the US large cap stock market. The technology sector, for example, remains a key growth driver. Companies like Apple, Microsoft, and Google continue to dominate their respective markets and have a strong presence in emerging technologies such as artificial intelligence and cloud computing. Additionally, the healthcare sector is expected to see significant growth, driven by an aging population and advancements in medical technology.

Case Studies

To illustrate the potential of investing in large cap stocks, let's consider the case of Apple Inc. Over the past year, Apple has seen a significant increase in its market capitalization, driven by strong demand for its products and services. The company's diversification into emerging markets and its robust financial position have made it a resilient performer in the face of market volatility.

Another example is Johnson & Johnson, a leader in the healthcare sector. Despite facing challenges in the wake of the COVID-19 pandemic, the company has continued to perform well, driven by strong demand for its pharmaceuticals and medical devices.

Conclusion

The US large cap stock market outlook for October 2025 is marked by a mix of challenges and opportunities. While geopolitical tensions, rising interest rates, and inflation concerns pose risks, the strength of leading companies in sectors like technology and healthcare offer potential for growth. As investors navigate this landscape, it is crucial to stay informed and focus on companies with strong fundamentals and resilient business models.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....