In the ever-evolving world of finance, investors are always on the lookout for new and exciting opportunities. One such opportunity that has been gaining traction is the potential of Hexo Corp (NYSE: HEXO) in the United States. In this article, we will delve into the details of Hexo stock, its market performance, and its potential as an investment.

Understanding Hexo Corp

Hexo Corp is a Canadian-based company specializing in the production and distribution of cannabis products. The company operates in several markets across North America, with a significant presence in the United States. Hexo's product range includes cannabis flowers, extracts, and infused products, catering to both recreational and medical consumers.

Market Performance

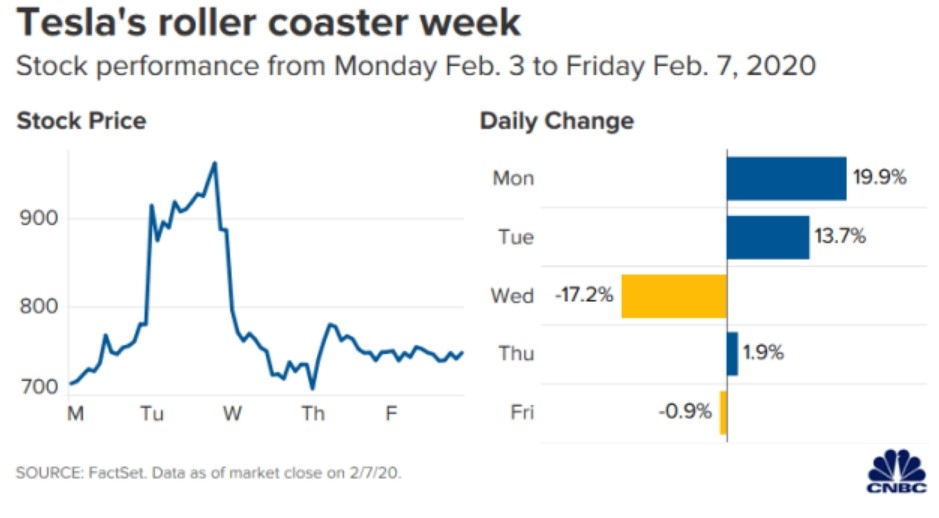

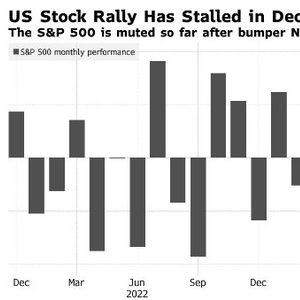

Hexo stock has seen its fair share of ups and downs in the United States. After its initial public offering (IPO) in 2018, the stock experienced a meteoric rise, reaching an all-time high of over $30 per share. However, due to the volatile nature of the cannabis industry and regulatory challenges, the stock has faced significant volatility.

In recent years, Hexo has faced several challenges, including increased competition, supply chain issues, and regulatory hurdles. Despite these challenges, the company has managed to maintain a strong presence in the market, with several strategic partnerships and expansions.

Investment Potential

Investors looking to invest in Hexo Corp should consider several factors before making a decision.

1. Market Potential: The United States cannabis market is one of the largest in the world, with significant growth potential. As more states legalize cannabis, the market is expected to expand further, presenting a strong opportunity for companies like Hexo.

2. Product Innovation: Hexo has been investing in product innovation, introducing new and unique cannabis products to the market. This focus on innovation could help the company gain a competitive edge and attract more customers.

3. Strategic Partnerships: Hexo has formed several strategic partnerships with leading companies in the industry, expanding its reach and capabilities. These partnerships could be a significant driver of growth for the company.

4. Regulatory Environment: The regulatory environment for cannabis in the United States is complex and evolving. Investors should closely monitor regulatory changes that could impact Hexo's operations and growth prospects.

Case Study: Canopy Growth Corporation

For context, let's take a look at Canopy Growth Corporation (TSX: WEED), a leading cannabis company in the United States. Canopy Growth has faced similar challenges to Hexo, but has managed to navigate the volatile market successfully. Through strategic partnerships, innovative products, and a strong focus on quality, Canopy Growth has become a major player in the industry.

Conclusion

Investing in Hexo Corp in the United States requires careful consideration of the market potential, product innovation, strategic partnerships, and regulatory environment. While the company faces challenges, its strong presence in the market and potential for growth make it an interesting investment opportunity for investors looking to diversify their portfolios.

new york stock exchange

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....