In the dynamic world of finance, stock prices play a pivotal role in the investment landscape. For investors and traders, understanding the factors that influence stock prices in the US market is crucial for making informed decisions. This article delves into the key elements that affect stock prices, providing insights into how investors can navigate the complexities of the market.

Market Dynamics and Stock Prices

The stock price of a company is a reflection of its market value. It is determined by the supply and demand dynamics in the market. When demand for a stock increases, its price tends to rise, and vice versa. Several factors contribute to these dynamics:

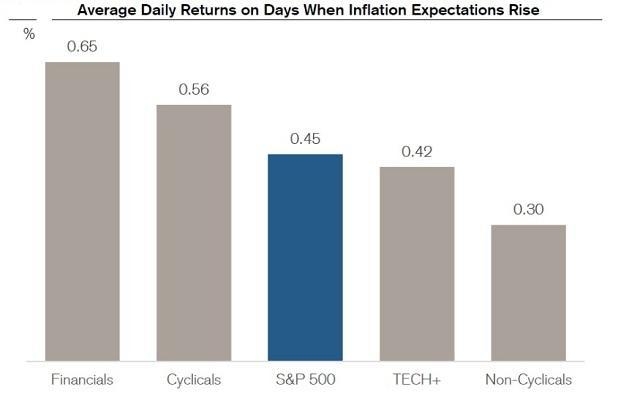

- Economic Indicators: Economic indicators such as GDP growth, unemployment rates, and inflation rates can significantly impact stock prices. For instance, a strong GDP growth rate can boost investor confidence, leading to higher stock prices.

- Company Performance: The financial performance of a company, including its revenue, profits, and earnings per share (EPS), is a critical factor in determining its stock price. Companies with strong financial performance tend to have higher stock prices.

- Market Sentiment: The overall sentiment of the market can also influence stock prices. Factors such as political events, natural disasters, or global economic crises can lead to changes in market sentiment, impacting stock prices.

Technical Analysis and Stock Prices

In addition to fundamental analysis, technical analysis is another important tool for understanding stock prices. Technical analysis involves studying historical price and volume data to identify patterns and trends. Some common technical indicators used in analyzing stock prices include:

- Moving Averages: Moving averages help identify the trend direction of a stock. For example, a rising moving average indicates an uptrend, while a falling moving average suggests a downtrend.

- Relative Strength Index (RSI): The RSI measures the speed and change of price movements. It ranges from 0 to 100 and is used to identify overbought or oversold conditions in a stock.

- Bollinger Bands: Bollinger Bands consist of a middle band and two outer bands. The middle band represents the stock's average price, while the outer bands represent standard deviations from the average. Bollinger Bands help identify potential entry and exit points for trades.

Case Study: Apple Inc.

To illustrate the impact of various factors on stock prices, let's consider the case of Apple Inc. (AAPL). Over the past few years, Apple's stock price has been influenced by several factors:

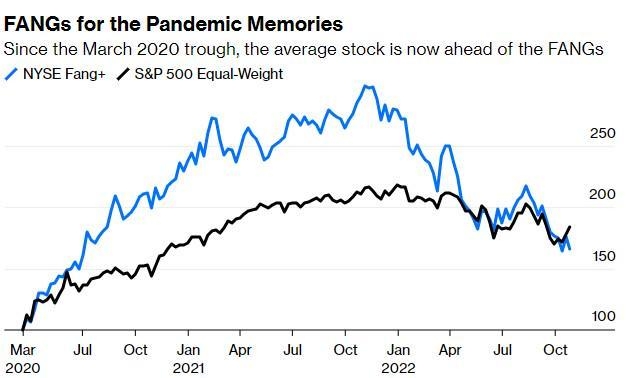

- Economic Indicators: During the global economic downturn in 2020, Apple's stock price fell along with the broader market. However, as the economy recovered, Apple's stock price began to rise.

- Company Performance: Apple's strong financial performance, driven by its popular products and services, has contributed to its higher stock price.

- Market Sentiment: The overall market sentiment has also played a role in Apple's stock price. For example, in 2021, Apple's stock price surged as investors became optimistic about the global economic recovery.

Conclusion

Understanding stock prices in the US market requires a comprehensive understanding of various factors, including economic indicators, company performance, and market sentiment. By utilizing both fundamental and technical analysis, investors can gain valuable insights into the complexities of the market and make informed decisions.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....