Introduction: In the ever-evolving global financial landscape, investors are increasingly seeking opportunities to diversify their portfolios. One popular strategy is rebalancing from US stocks to foreign stocks. This article delves into the reasons behind this shift, the potential benefits, and the key considerations for investors looking to diversify their investments.

Understanding the Shift

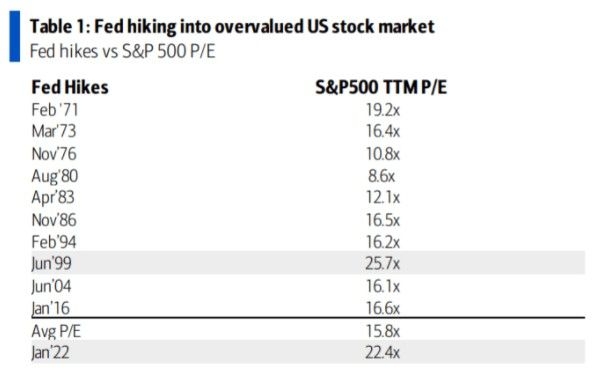

The shift from US stocks to foreign stocks is driven by several factors. Firstly, the US stock market has been on a remarkable rally over the past few years, leading to increased valuations. As a result, some investors are looking for value elsewhere. Secondly, with the rise of emerging markets and the growth of developed economies, foreign stocks offer attractive opportunities for growth and income generation.

Benefits of Rebalancing

Diversification: Investing in foreign stocks can help reduce the risk of portfolio volatility. By diversifying across different markets, investors can mitigate the impact of any single market's downturn.

Growth Opportunities: Many emerging markets are experiencing rapid economic growth, offering significant potential for long-term capital appreciation. Investing in foreign stocks can provide access to these growth opportunities.

Income Generation: Some foreign stocks offer higher dividend yields compared to their US counterparts. This can be particularly appealing for income-seeking investors.

Currency Exposure: Investing in foreign stocks can provide exposure to different currencies, which can potentially enhance returns or offset currency fluctuations.

Key Considerations

Market Research: Conduct thorough research to identify attractive foreign stocks and markets. Consider factors such as economic stability, political environment, and market liquidity.

Risk Tolerance: Assess your risk tolerance and investment goals. Foreign stocks may carry higher risks compared to US stocks, including currency risk and political risk.

Diversification Strategy: Develop a diversified investment strategy that includes a mix of foreign stocks across different sectors and regions.

Professional Advice: Consider seeking advice from a financial advisor to ensure that your investment strategy aligns with your goals and risk tolerance.

Case Studies

India: Over the past decade, the Indian stock market has delivered impressive returns. Companies like Reliance Industries and Infosys have seen significant growth, making India an attractive destination for foreign investors.

China: Despite recent market volatility, China remains a key player in the global economy. Companies like Tencent and Alibaba offer exposure to the rapidly growing technology and e-commerce sectors.

Conclusion:

Rebalancing from US stocks to foreign stocks can be a strategic move for investors looking to diversify their portfolios and capitalize on global growth opportunities. By conducting thorough research, assessing risk tolerance, and seeking professional advice, investors can make informed decisions and potentially enhance their investment returns.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....