Are you considering adding US stocks to your Tax-Free Savings Account (TFSA)? Investing in US stocks through your TFSA can be a wise financial move, offering a range of benefits that can help grow your wealth over time. In this article, we'll explore the advantages of holding US stocks in your TFSA, how to do it, and some key considerations to keep in mind.

Understanding the TFSA

First, let's clarify what a TFSA is. A Tax-Free Savings Account is a registered account in Canada that allows you to save and invest money without paying taxes on the interest, dividends, or capital gains earned within the account. This makes it an attractive option for long-term saving and investing.

Benefits of Holding US Stocks in Your TFSA

1. Diversification: One of the primary advantages of holding US stocks in your TFSA is diversification. By investing in a variety of companies across different sectors and geographical locations, you can reduce your risk and potentially increase your returns.

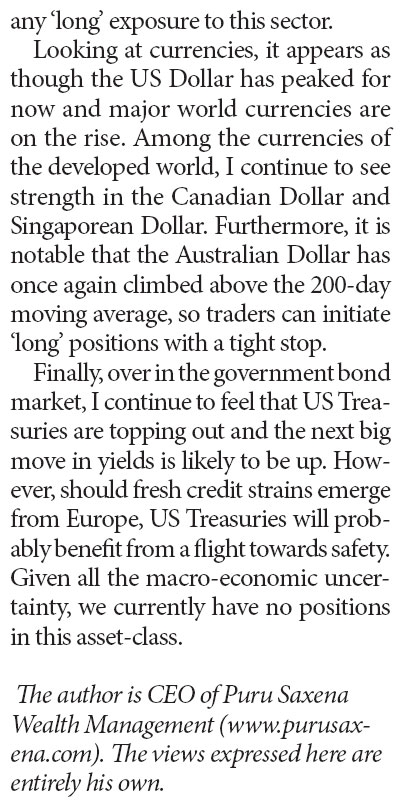

2. Access to World-Class Companies: The US stock market is home to some of the world's most successful and innovative companies. By investing in US stocks, you can gain exposure to these companies and potentially benefit from their growth.

3. Currency Conversion: When you invest in US stocks through your TFSA, any dividends or capital gains are converted back to Canadian dollars. This can be a tax-efficient way to invest in foreign stocks.

How to Hold US Stocks in Your TFSA

To hold US stocks in your TFSA, you'll need to follow these steps:

Open a TFSA: If you don't already have a TFSA, you'll need to open one. You can do this through a bank, credit union, or investment firm.

Choose a Broker: Next, choose a brokerage firm that offers access to US stocks. Many Canadian brokers offer this service, so compare fees and features to find the best option for you.

Transfer Funds: Transfer funds from your TFSA to your brokerage account. This will give you the capital you need to purchase US stocks.

Buy US Stocks: Use your brokerage account to buy US stocks. You can purchase individual stocks or invest in a US stock fund.

Key Considerations

1. Research: Before investing in US stocks, do your research. Understand the company's financial health, industry position, and growth prospects.

2. Fees: Be aware of any fees associated with holding US stocks in your TFSA, such as brokerage fees, currency conversion fees, and management fees.

3. Risk: Investing in foreign stocks can come with additional risks, such as currency fluctuations and political instability. Be prepared to manage these risks.

Case Study: Apple Inc.

Let's take a look at a real-world example. Apple Inc. is a well-known US technology company that has been a strong performer in the stock market. If you had invested

In conclusion, holding US stocks in your TFSA can be a smart investment strategy. By diversifying your portfolio, accessing world-class companies, and taking advantage of the tax benefits of a TFSA, you can potentially grow your wealth over time. Just remember to do your research, manage risks, and choose the right investments for your goals.

google stock price

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....