The US total stock market cap is a crucial metric that reflects the total value of all stocks listed on the major exchanges in the United States. It serves as a barometer of the overall health and growth potential of the economy. In this article, we will delve into what the US total stock market cap represents, its significance, and how it has evolved over the years.

Understanding the US Total Stock Market Cap

The US total stock market cap is calculated by multiplying the price of each stock by the number of shares outstanding. This figure is then summed up across all publicly traded companies in the United States. It includes shares listed on the New York Stock Exchange, NASDAQ, American Stock Exchange, and other regional exchanges.

Significance of the US Total Stock Market Cap

Economic Health Indicator: The US total stock market cap is a vital indicator of the health of the economy. A rising market cap suggests that investors are optimistic about the future, leading to increased capital investment and economic growth. Conversely, a falling market cap can signal economic uncertainty and potential downturn.

Market Value of Companies: The US total stock market cap provides a snapshot of the market value of all publicly traded companies in the United States. This information is useful for investors, analysts, and policymakers to assess the overall size and strength of the economy.

Inflation and Interest Rates: The US total stock market cap is closely linked to inflation and interest rates. When the market cap is high, inflation tends to be low, and interest rates are stable. This is because investors are willing to pay a premium for stocks, leading to increased demand for loans and investment.

Evolution of the US Total Stock Market Cap

Over the years, the US total stock market cap has experienced significant fluctuations. Here are a few key milestones:

- 2000 Tech Bubble: In the early 2000s, the dot-com bubble burst, leading to a sharp decline in the US total stock market cap. This period was characterized by overvalued technology stocks and speculative investment.

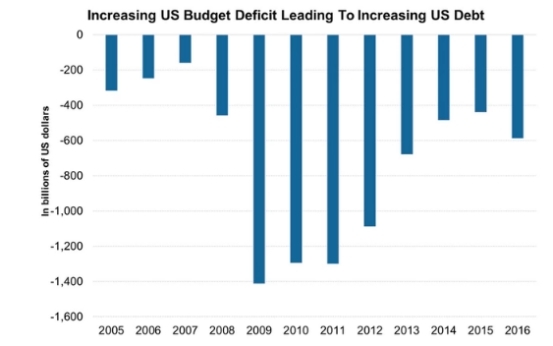

- 2008 Financial Crisis: The 2008 financial crisis resulted in a dramatic fall in the US total stock market cap, as investors feared widespread economic collapse. However, the market recovered quickly, thanks to government intervention and strong economic policies.

- 2020 Pandemic: The COVID-19 pandemic led to another significant drop in the US total stock market cap. However, just like in 2008, the market quickly rebounded, driven by unprecedented stimulus measures and vaccine rollouts.

Case Study: The S&P 500

One of the most popular benchmarks for the US total stock market cap is the S&P 500 Index. This index represents the market value of 500 large companies listed on the NYSE and NASDAQ. The S&P 500 has been a reliable indicator of the overall stock market performance and serves as a proxy for the US total stock market cap.

In 2019, the S&P 500 reached an all-time high of over 3,200. However, it experienced a sharp decline in early 2020, falling to around 2,200. By the end of the year, the index had recovered to around 3,800, reflecting the resilience of the US stock market.

Conclusion

The US total stock market cap is a critical indicator of the overall health and growth potential of the American economy. Understanding its significance and evolution over time can help investors, analysts, and policymakers make informed decisions. As the stock market continues to evolve, keeping an eye on the US total stock market cap will remain a key component in evaluating the economic landscape.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....