Introduction

The US stock market has been a key indicator of economic health and investment trends for decades. In May 2025, the market saw a mix of growth, volatility, and significant shifts in investor sentiment. This weekly summary will delve into the major developments, performance highlights, and future outlook for the US stock market.

Market Performance

The S&P 500 Index, a widely followed benchmark for the US stock market, experienced a volatile month in May. The index opened the month at 4,300 points and closed at 4,150 points, marking a loss of 4.5%. However, the NASDAQ Composite, which represents technology stocks, managed to close the month at 14,200 points, a gain of 2%.

Sector Performance

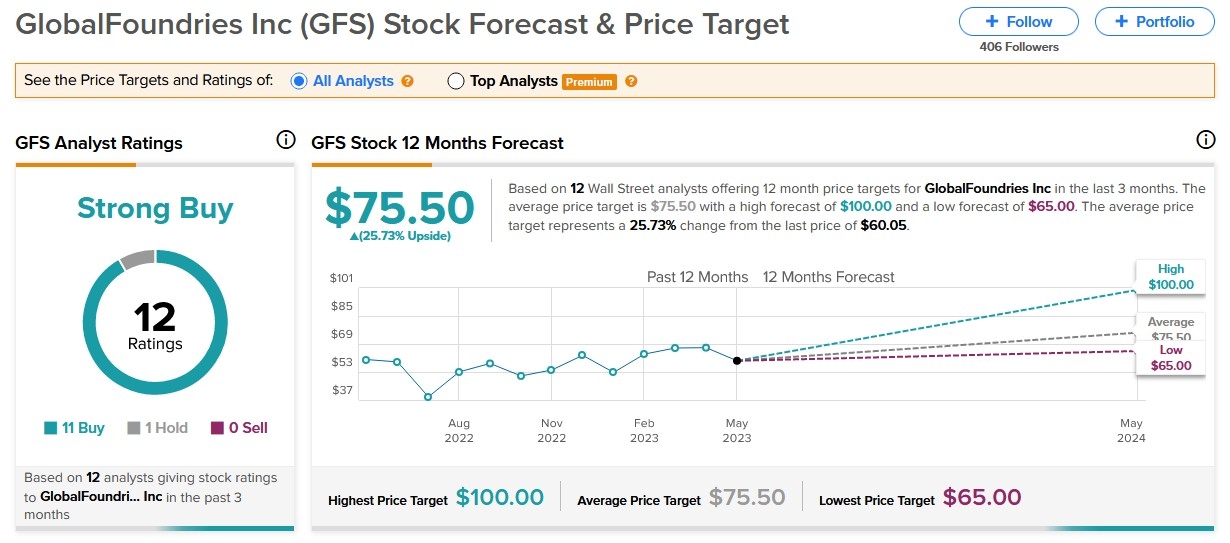

Several sectors saw significant movement in May. The technology sector, led by companies like Apple and Microsoft, saw the largest gains, with a rise of 6%. The energy sector, driven by the rise in oil prices, also performed well, with a gain of 4%. On the other hand, the healthcare sector, which includes companies like Johnson & Johnson and Pfizer, saw a loss of 3% due to concerns about rising drug prices and regulatory scrutiny.

Key Developments

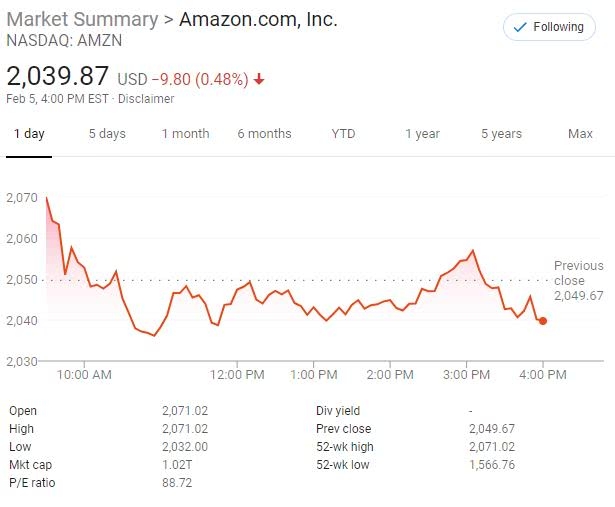

Corporate Earnings: Many major companies reported strong earnings during May, with several surpassing analyst expectations. This included companies like Amazon, which reported earnings per share of

12.94, compared to the expected 10.70.FED Rate Hike: The Federal Reserve raised interest rates for the third time this year, signaling its commitment to controlling inflation. The move caused some uncertainty in the market, but investors remained optimistic about the long-term prospects for economic growth.

Economic Data: The US economy continued to show signs of strength, with jobless claims remaining low and consumer spending increasing. However, concerns about rising inflation and supply chain disruptions continued to weigh on the market.

Stock Market Analysis

The volatility in the stock market in May 2025 can be attributed to several factors. The Federal Reserve's rate hike and concerns about inflation were the primary drivers of uncertainty. However, the strong corporate earnings and economic data provided some support for the market.

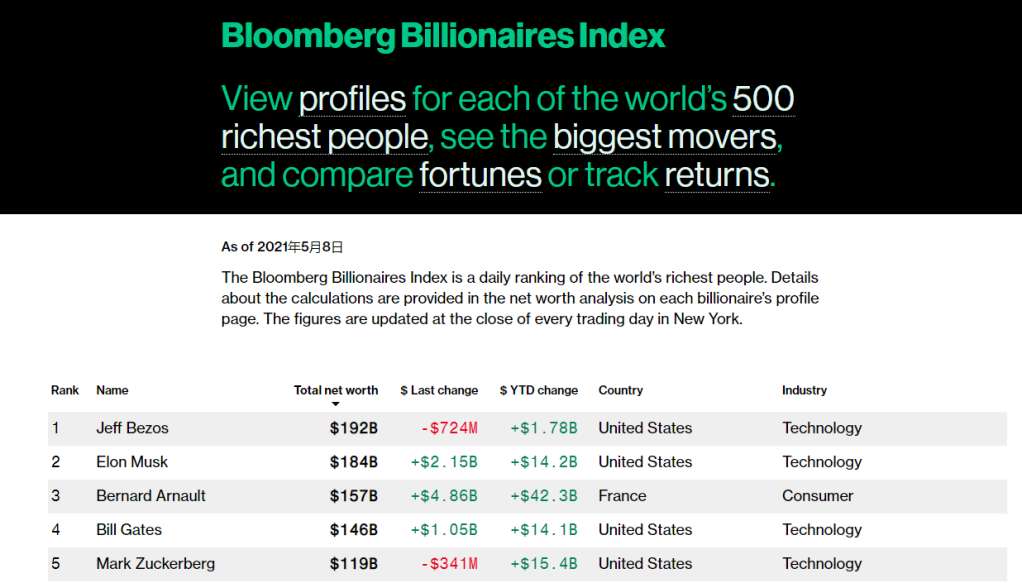

One key factor that influenced investor sentiment was the performance of the technology sector. Companies like Apple and Microsoft continued to grow despite the broader market volatility. This indicates that investors remain confident in the long-term prospects of the tech industry.

Case Study: Amazon

Amazon, the world's largest online retailer, reported earnings per share of

Conclusion

The US stock market in May 2025 experienced a mix of growth, volatility, and significant shifts in investor sentiment. While concerns about inflation and economic uncertainty remain, the strong corporate earnings and economic data provide a cautiously optimistic outlook for the future. As investors continue to navigate these complex market conditions, it's crucial to stay informed and make informed investment decisions.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....