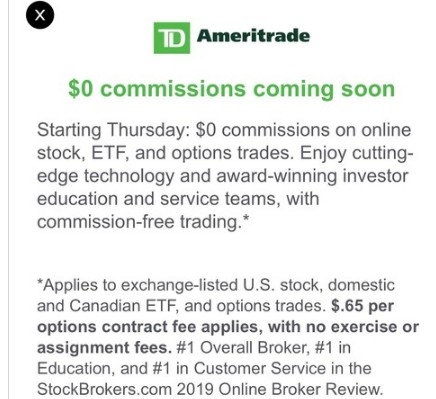

Embarking on the journey of investing in international markets, particularly in stocks and shares, can be both exhilarating and daunting. For US investors, understanding the taxation implications is crucial to maximize returns and avoid costly penalties. This article delves into the nuances of Stocks and Shares ISA and how it pertains to US taxation.

What is a Stocks and Shares ISA?

Firstly, let’s clarify what a Stocks and Shares ISA (Individual Savings Account) is. An ISA is a tax-advantaged investment account available in the UK. It allows investors to invest in a variety of assets, including stocks, bonds, and exchange-traded funds (ETFs), without paying any capital gains tax or income tax on dividends.

US Taxation and Stocks and Shares ISA

Now, let’s delve into how Stocks and Shares ISA impacts US taxation. Under the Tax Cuts and Jobs Act (TCJA) of 2017, US citizens or residents are required to report their foreign financial accounts, including ISAs, if the value exceeds $10,000 at any time during the year.

Here are the key aspects to consider:

1. Reporting Requirements:

- FBAR (FinCEN Form 114): If the value of your ISA exceeds $10,000 at any time during the year, you are required to file an FBAR with the Financial Crimes Enforcement Network (FinCEN).

- Form 8938: You may also need to report the ISA on Form 8938 if it exceeds certain thresholds based on your filing status.

2. Taxation of Dividends and Gains:

- Dividends: Dividends received from UK stocks held within an ISA are not subject to US taxation. However, if you withdraw funds from the ISA and reinvest them in non-UK stocks, the dividends may be subject to US tax.

- Gains: Gains realized from selling stocks within an ISA are not taxed in the UK. However, when withdrawn and reinvested in non-UK stocks, the gains may be subject to capital gains tax in the US.

3. Withdrawing Funds:

When withdrawing funds from a Stocks and Shares ISA, you should be aware of the potential tax implications:

- Tax-Free Allowance: The first £10,000 withdrawn from an ISA in any given tax year is tax-free. However, any amount over £10,000 may be subject to income tax.

- Early Withdrawal Penalties: If you withdraw funds from an ISA before the age of 59½, you may be subject to an early withdrawal penalty of 5%.

Case Study:

Imagine John, a US citizen, invested £20,000 in a Stocks and Shares ISA. He held the ISA for five years and decided to withdraw £30,000. Since £20,000 is within the tax-free allowance, John is only taxed on the remaining £10,000. Assuming a marginal tax rate of 25%, John would owe £2,500 in income tax.

Conclusion:

Investing in Stocks and Shares ISA can offer significant tax advantages for US investors. However, it is crucial to understand the reporting requirements and potential tax implications to ensure compliance with US tax laws. Always consult with a tax professional or financial advisor to tailor your investment strategy to your specific needs and circumstances.

vanguard total stock market et

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....