In today's fast-paced financial world, the stock price of a company is a critical indicator of its performance and market value. Yahoo, once a dominant force in the tech industry, has seen its stock price fluctuate significantly over the years. In this article, we'll delve into the factors influencing Yahoo's stock price and explore its current and future prospects.

Historical Stock Price Performance

Yahoo's stock price has experienced several peaks and troughs since its initial public offering (IPO) in 1996. At its peak, in 2000, Yahoo's stock price reached over

Factors Influencing Yahoo's Stock Price

Several factors have contributed to Yahoo's fluctuating stock price:

Market Competition: Yahoo has faced stiff competition from tech giants like Google, Facebook, and Amazon. This competition has led to a decline in Yahoo's market share and advertising revenue.

Strategic Missteps: Yahoo has made several strategic missteps over the years, including the failure to acquire key assets like Google and Facebook. These missteps have impacted the company's growth and profitability.

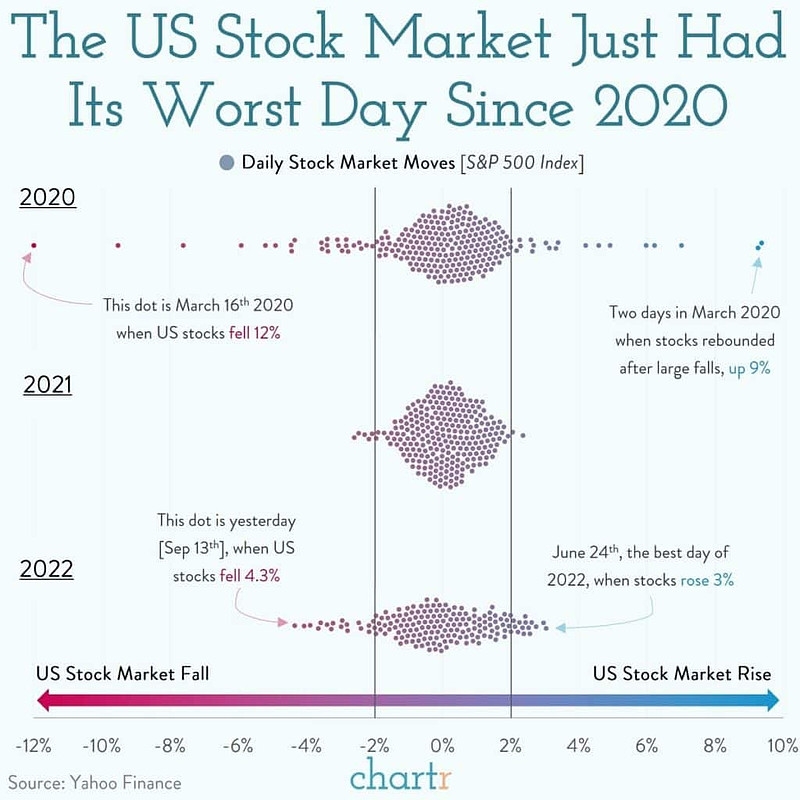

Economic Factors: Economic conditions, such as the 2008 financial crisis, have also played a role in Yahoo's stock price fluctuations.

Yahoo's Current Stock Price

As of the time of writing, Yahoo's stock price is hovering around $45 per share. This represents a significant improvement from its lowest point but still well below its all-time high.

Future Prospects

Yahoo's future prospects remain uncertain. The company has been trying to revitalize its business through various initiatives, including:

Alibaba Investment: Yahoo holds a significant stake in Alibaba, a Chinese e-commerce giant. This investment has provided Yahoo with a stable source of revenue and has helped improve its financial performance.

Focus on Advertising: Yahoo is trying to regain its position in the advertising market by focusing on targeted advertising and content partnerships.

Strategic Partnerships: Yahoo has entered into several strategic partnerships with other companies, such as Verizon, to enhance its offerings and expand its reach.

Case Study: Yahoo's Acquisition by Verizon

In 2017, Yahoo was acquired by Verizon for $4.48 billion. This acquisition was seen as a way for Yahoo to gain stability and access to Verizon's resources. However, the acquisition has not been without its challenges. The integration of Yahoo's operations with Verizon's has been slow, and the company continues to face competition from tech giants.

Conclusion

Yahoo's stock price has been volatile over the years, reflecting the company's struggles to maintain its position in the tech industry. While the company has made progress in recent years, its future remains uncertain. As investors, it's important to closely monitor Yahoo's performance and the factors influencing its stock price.

Keywords: Yahoo Company Stock Price, Yahoo Stock, Yahoo Stock Performance, Yahoo Stock Market, Yahoo Stock Analysis, Yahoo Stock Forecast, Yahoo Stock Trends

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....