The recent decision by the Federal Reserve to cut interest rates has sent ripples through the global financial market. As investors across the world analyze the implications, one key question looms large: what does this interest rate cut mean for Japanese stocks? In this article, we delve into the potential effects of the US interest rate cut on Japanese stocks, offering insights into how this move might influence investment strategies.

Understanding the Background

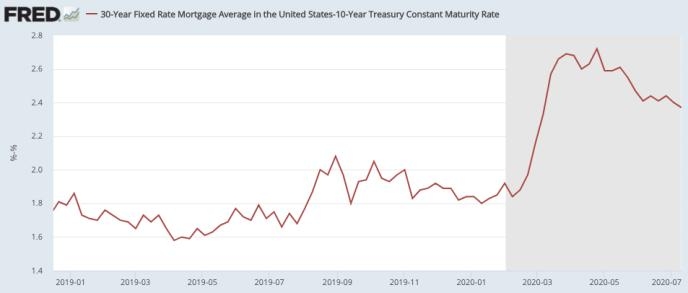

The Federal Reserve's decision to cut interest rates from 2.25% to 2.00% was motivated by concerns about the slowing global economy, particularly in the wake of trade tensions between the US and China. This move, which followed the central bank's rate cut in July, reflects a broader trend of central banks around the world lowering interest rates to stimulate economic growth.

Impact on Japanese Stocks

The reduction in US interest rates has several potential effects on Japanese stocks:

Yen Depreciation: A decrease in US interest rates makes US assets relatively less attractive to foreign investors, leading to a depreciation of the US dollar. This, in turn, strengthens the yen, which could negatively impact Japanese exporters. However, it could also lead to increased foreign investment in Japanese stocks, as they become more attractive due to the stronger yen.

Lower Yen Borrowing Costs: A weaker yen makes Japanese companies' overseas earnings more valuable in yen terms, potentially boosting their stock prices. Additionally, Japanese companies may find it cheaper to borrow in yen to finance expansion or acquisitions.

Increase in Equity Inflows: The lower interest rates in the US may attract more foreign investors to Japanese stocks, seeking higher yields. This increased demand could drive up stock prices.

Shift in Investment Preferences: Investors may shift their focus from bonds to stocks, especially in sectors that benefit from lower interest rates, such as real estate and technology.

Case Study: Toyota

One notable example of the potential impact of the US interest rate cut on Japanese stocks is Toyota Motor Corporation. As the yen strengthened following the rate cut, Toyota's overseas earnings translated into more yen, potentially boosting its stock price. Additionally, the weaker yen made Toyota's products more competitive internationally, which could also be beneficial for the company's financial performance and, subsequently, its stock price.

Conclusion

The US interest rate cut has the potential to significantly impact Japanese stocks. While the exact effects will depend on various factors, including the strength of the yen and global economic conditions, investors should closely monitor these developments. By understanding the potential risks and opportunities, investors can make more informed decisions about their portfolios.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....