Introduction:

The upcoming US election is not just a political event; it has the potential to significantly impact the stock market. Investors around the world are closely monitoring the race, anticipating the outcomes that could shape the future of their investments. In this article, we delve into how the US election could affect the stock market, with a focus on key sectors and historical precedents.

The Political Divide and Market Sentiment:

The current political landscape in the US is highly polarized, with differing views on economic policies, trade, and social issues. This divide is expected to play a crucial role in influencing market sentiment. For instance, a win for one candidate may lead to optimism in certain sectors, while a victory for the other could spark concerns.

Potential Impact on Key Sectors:

Technology Sector:

The technology sector is one of the most influential in the stock market. A candidate favoring stricter regulations on tech giants like Google, Apple, and Facebook could lead to uncertainty and a potential decline in tech stocks. Conversely, a candidate with a more pro-business stance might boost the sector's growth prospects.

Energy Sector:

The energy sector is sensitive to changes in political landscapes. A win for a candidate emphasizing renewable energy sources could lead to a surge in clean energy stocks. However, a victory for a candidate with a pro-fossil fuel stance might benefit oil and gas companies, potentially leading to increased stock prices in this sector.

Financial Sector:

The financial sector is expected to be significantly impacted by the election, with varying implications for different types of financial institutions. A candidate favoring more stringent financial regulations could lead to lower profitability for banks and financial institutions, while a pro-business candidate might foster a more favorable environment for growth.

Historical Precedents:

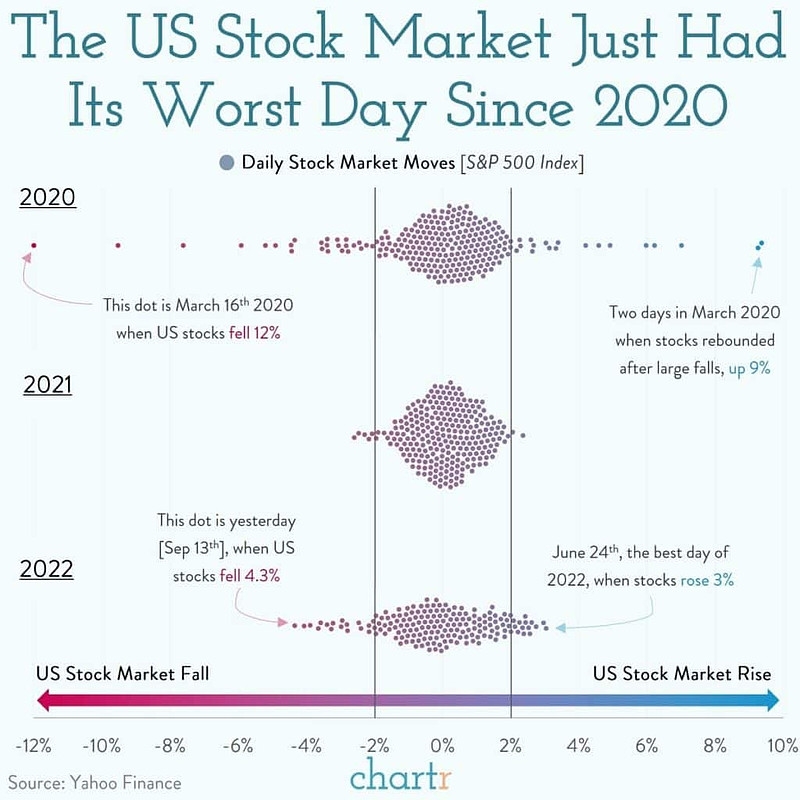

History has shown that elections can have a substantial impact on the stock market. For example, the 2016 election saw a significant rally in the stock market after Donald Trump's victory, with investors anticipating pro-business policies. Similarly, the 2008 election, which saw the election of Barack Obama, led to a period of volatility in the stock market, as investors anticipated significant policy changes.

Case Study: The 2008 Election and Stock Market Volatility

The 2008 election, marked by the election of Barack Obama, saw the stock market experiencing considerable volatility. The year prior to the election, the S&P 500 Index lost nearly 40% of its value. However, in the months following Obama's victory, the index rallied significantly, gaining approximately 26% over the next year. This illustrates how political events can significantly influence market movements.

Conclusion:

The upcoming US election is a pivotal moment that could have profound implications for the stock market. Investors must stay informed about the candidates' policies and their potential impact on key sectors. By understanding the political landscape and historical precedents, investors can make more informed decisions regarding their investments. As the election approaches, it is crucial to keep a close eye on the race and its potential impact on the stock market.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....