In the dynamic world of tech stocks, Tesla Inc. (NASDAQ: TSLA) has become a symbol of innovation and ambition. As the leading electric vehicle (EV) manufacturer, Tesla's stock performance on NASDAQ has sparked considerable interest among investors and tech enthusiasts. This article delves into the key aspects of Tesla's stock, offering valuable insights for those looking to understand the company's market trajectory.

Tesla Stock Performance

Tesla's stock performance on NASDAQ has been anything but predictable. The stock, which has experienced both remarkable highs and lows, has managed to attract a wide range of investors, from long-term holders to speculative traders. Since its initial public offering (IPO) in 2010, Tesla's stock has surged, reflecting the company's rapid growth and market leadership in the EV sector.

Understanding the Market Dynamics

Tesla's stock performance can be attributed to various factors. One of the most significant is the company's strong financial results, including its record-breaking deliveries and robust revenue growth. Additionally, Tesla's expansion into new markets, such as China and Europe, has contributed to its market capitalization.

Moreover, Tesla's CEO, Elon Musk, has played a pivotal role in shaping the company's image and stock performance. His visionary leadership and bold statements have often generated media buzz, impacting investor sentiment.

Impact of Global Trends on Tesla Stock

The global shift towards sustainable energy and the increasing demand for EVs have significantly impacted Tesla's stock performance. Governments around the world are implementing policies to encourage the adoption of EVs, further driving demand for Tesla's products. This trend is expected to continue, providing a strong foundation for Tesla's growth.

Comparative Analysis

To understand Tesla's stock performance, it's essential to compare it with other major tech companies. While Tesla has seen impressive growth, companies like Apple Inc. (NASDAQ: AAPL) and Microsoft Corporation (NASDAQ: MSFT) have also performed well in recent years. However, Tesla's unique position in the EV market sets it apart from its tech industry peers.

Tesla Stock Valuation

Tesla's stock valuation has been a subject of debate among analysts and investors. The company is often considered to be overvalued, given its high market capitalization and the risks associated with its growth. However, some experts argue that Tesla's long-term potential justifies its valuation.

Key Milestones and Challenges

Tesla has achieved several key milestones, such as the production of its first mass-market vehicle, the Model 3. The company has also made significant strides in battery technology and autonomous driving. However, Tesla faces challenges, including increased competition, regulatory hurdles, and supply chain issues.

Investment Perspective

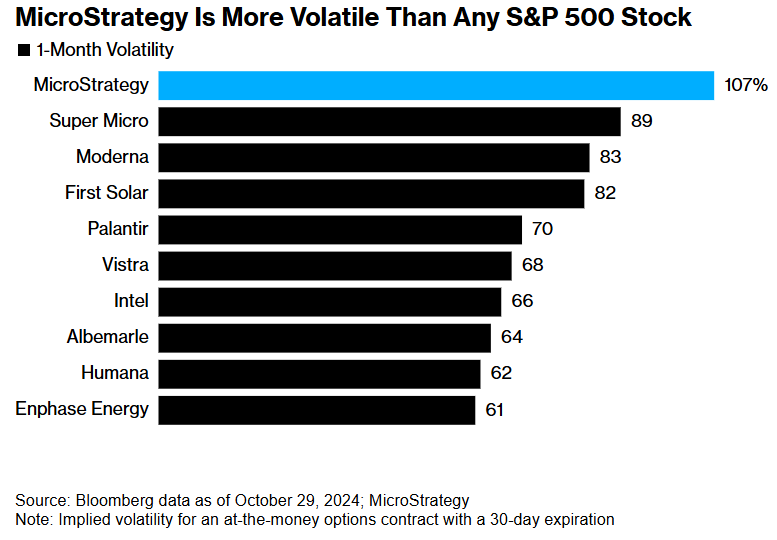

For investors considering Tesla stock, it's crucial to weigh the company's growth potential against its risks. While Tesla has a promising future, the stock's volatility makes it a high-risk, high-reward investment. Diversifying your portfolio and conducting thorough research before investing is advisable.

Conclusion

Tesla's stock performance on NASDAQ has captured the attention of investors worldwide. As the EV market continues to grow, Tesla's future remains uncertain but exciting. By understanding the key aspects of the company and its stock, investors can make informed decisions regarding their investment strategy.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....