In the ever-evolving landscape of global finance, Sberbank, one of Russia's largest financial institutions, has made significant strides in the United States. This article delves into the intricacies of Sberbank's stock performance in the US market, exploring its impact, potential, and future prospects.

Understanding Sberbank's Presence in the US

Sberbank, with its headquarters in Moscow, has expanded its operations globally, including a strong presence in the United States. The bank's stock, known as "Sberbank OJSC" (ticker: SBER), is listed on the London Stock Exchange and the Moscow Exchange. However, its performance in the US market is a subject of great interest among investors.

Historical Performance of Sberbank Stock in the US

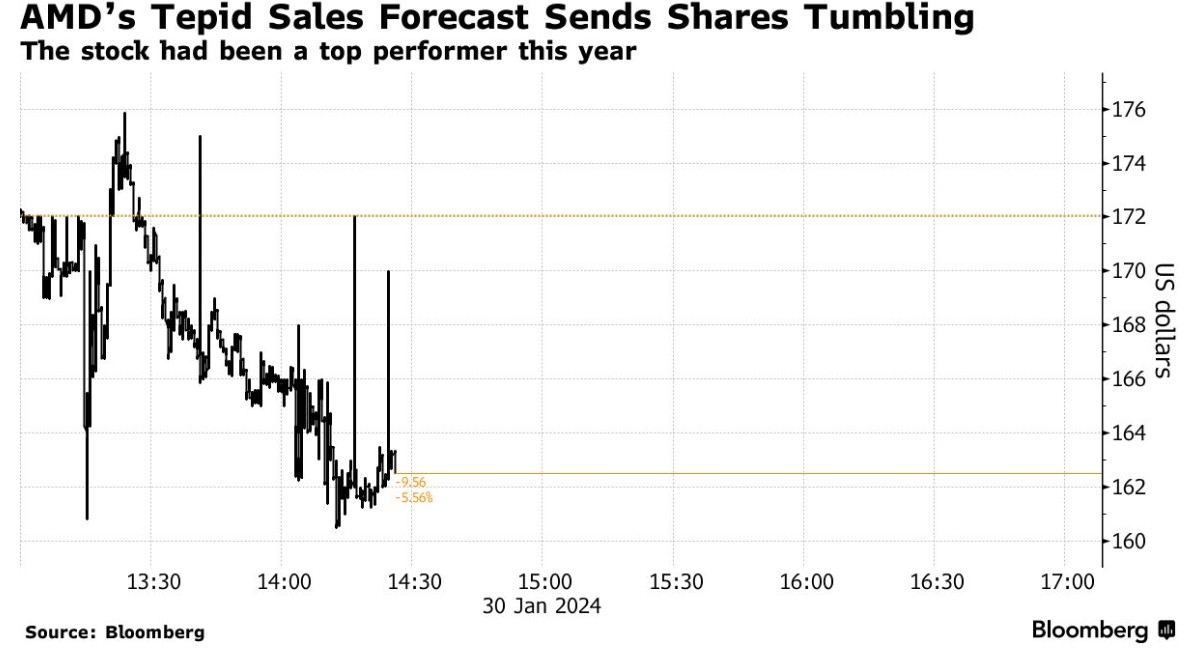

Over the years, the performance of Sberbank stock in the US has been quite volatile. Historical data reveals that the stock has experienced both significant growth and periods of decline. For instance, in 2019, the stock reached an all-time high, but faced downward pressure in 2020 due to global economic uncertainties, especially in the wake of the COVID-19 pandemic.

Factors Influencing Sberbank Stock Performance

Several factors contribute to the performance of Sberbank stock in the US. These include:

- Economic Conditions: The economic health of both Russia and the US significantly impacts the stock's performance. Factors such as inflation, interest rates, and GDP growth rates play a crucial role.

- Geopolitical Factors: Russia's relations with the US and other global powers can influence investor sentiment and, consequently, the stock's performance.

- Bank Performance: Sberbank's financial performance, including its profitability, asset quality, and growth prospects, are key drivers of the stock's valuation.

Recent Developments and Future Prospects

In recent years, Sberbank has been focusing on digital transformation, which has been well-received by investors. The bank's efforts to expand its digital offerings, including mobile banking and digital lending, have been a positive factor in its stock performance.

Looking ahead, the future prospects for Sberbank stock in the US appear promising. The bank's strategic initiatives, coupled with a strong presence in key markets, position it well for continued growth. However, potential risks such as geopolitical tensions and economic uncertainties remain a concern.

Case Study: Sberbank's Expansion into the US

One notable example of Sberbank's expansion into the US is its partnership with fintech companies. In 2018, Sberbank entered into a strategic partnership with a US-based fintech company, providing digital banking solutions to customers in the US. This partnership not only helped Sberbank gain a foothold in the US market but also demonstrated its commitment to innovation and digital transformation.

Conclusion

Sberbank stock in the US has experienced a mix of growth and volatility. However, the bank's strategic initiatives and digital transformation efforts provide a positive outlook for the future. As investors continue to monitor the global economic landscape, Sberbank's performance in the US market will be a key area of focus.

us stock market today live cha

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....