When it comes to building a diversified investment portfolio, the question of how much to allocate to international stocks versus U.S. stocks often arises. This article delves into the factors to consider when determining the optimal balance between these two types of investments.

Understanding the Difference

Firstly, it's important to understand the difference between international and U.S. stocks. U.S. stocks represent shares of companies based in the United States, while international stocks are shares of companies based outside the United States. This distinction can have significant implications for your investment strategy.

Diversification

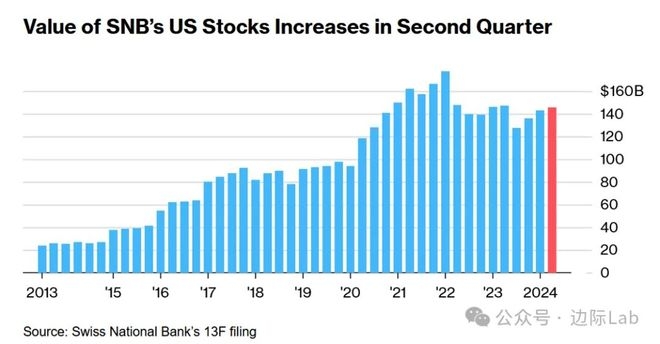

One of the primary reasons for including international stocks in your portfolio is diversification. By investing in a mix of U.S. and international stocks, you can reduce your exposure to market-specific risks. This is particularly important in times of market volatility, as international markets often react differently to the same economic events as the U.S. market.

Economic Factors

Economic factors also play a crucial role in determining the optimal allocation between international and U.S. stocks. For instance, if the U.S. dollar is strong, U.S. stocks may be more attractive due to their higher valuations. Conversely, if the dollar is weak, international stocks may offer better value.

Market Cycles

Market cycles can also influence the allocation between international and U.S. stocks. For example, during periods of strong economic growth, U.S. stocks may outperform international stocks. However, during periods of economic uncertainty, international stocks may offer more stability.

Risk Tolerance

Your risk tolerance is another important factor to consider. If you are risk-averse, you may prefer a higher allocation to U.S. stocks, which are generally considered to be less risky than international stocks. On the other hand, if you are comfortable with higher levels of risk, you may opt for a higher allocation to international stocks, which can offer higher potential returns.

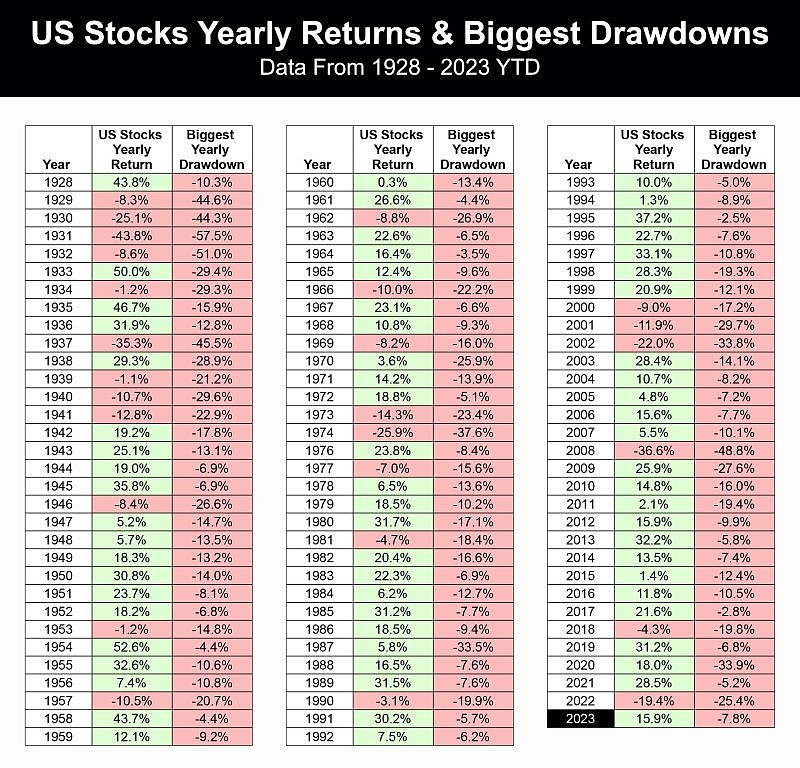

Historical Performance

Historically, international stocks have offered higher returns than U.S. stocks. This is due to the fact that many international markets have higher growth rates and lower valuations. However, it's important to note that past performance is not indicative of future results.

Case Study: Tech Stocks

A prime example of the potential benefits of international investing is the tech sector. While the U.S. tech industry is dominant, there are many innovative companies in other countries that offer compelling investment opportunities. For instance, China's technology sector has seen significant growth in recent years, with companies like Tencent and Alibaba leading the way.

Conclusion

In conclusion, determining the optimal allocation between international and U.S. stocks depends on various factors, including diversification, economic factors, market cycles, risk tolerance, and historical performance. While U.S. stocks are often considered less risky, international stocks can offer higher potential returns. It's important to carefully consider these factors and consult with a financial advisor to make informed decisions about your investment strategy.

us stock market today

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....