In 2015, the US stock market experienced a tumultuous yet rewarding year. With numerous ups and downs, investors had to navigate through various challenges. This article delves into the performance of the US stock market in 2015, highlighting key trends, market movements, and the factors that influenced the market's trajectory.

Market Overview

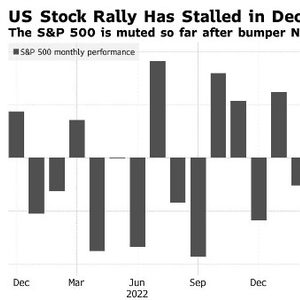

The S&P 500, a widely followed benchmark index, closed the year at 2,047.52, marking a 1.4% increase from its closing level in 2014. While this may seem like a modest gain, it's important to note that the market faced several headwinds during the year, including concerns over global economic growth, China's stock market turmoil, and the Federal Reserve's decision to raise interest rates.

Key Trends

Volatility: The US stock market in 2015 was characterized by high volatility. The S&P 500 experienced its worst trading day in 2015 on February 9, when it fell by 2.2%. However, the market quickly recovered, and by the end of the year, had posted a positive return.

Sector Performance: Technology and healthcare sectors outperformed the broader market in 2015. Companies like Apple and Amazon saw significant gains, driven by strong earnings reports and increasing demand for their products and services.

Dividend Stocks: Investors seeking income turned to dividend-paying stocks. Companies like Procter & Gamble and Johnson & Johnson saw increased demand for their shares, as investors sought stability and income in a volatile market.

Market Movements

January 2015: The market started the year on a strong note, with the S&P 500 reaching an all-time high on January 20. However, concerns over global economic growth and China's stock market turmoil led to a sharp decline in February.

Mid-Year Recovery: The market began to recover in the second half of the year, driven by strong corporate earnings and positive economic data. The S&P 500 closed the year with a modest gain.

Federal Reserve Rate Hike: The Federal Reserve raised interest rates for the first time in nearly a decade in December 2015. While this move was widely anticipated, it still caused some volatility in the market.

Factors Influencing the Market

Global Economic Concerns: Concerns over global economic growth, particularly in China and Europe, impacted investor sentiment throughout the year.

China's Stock Market Turmoil: In June 2015, China's stock market experienced a sharp decline, spurring fears of a global economic slowdown. This event had a significant impact on investor confidence and market movements.

Corporate Earnings: Strong corporate earnings reports, particularly from the technology and healthcare sectors, helped to boost investor confidence and support the market's recovery.

Case Studies

Apple: Apple's strong performance in 2015 was driven by the launch of the iPhone 6s and 6s Plus, as well as robust sales of services like Apple Music and iCloud. The company's shares closed the year with a gain of 12%.

Johnson & Johnson: Johnson & Johnson, a dividend-paying healthcare giant, saw increased demand for its shares in 2015. The company's shares closed the year with a gain of 5%.

In conclusion, the US stock market in 2015 experienced a rollercoaster of emotions, but ultimately delivered a positive return. Investors had to navigate through various challenges, including global economic concerns and market volatility. However, strong corporate earnings and sector outperformance helped to drive the market's recovery.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....