Investing in stocks can be a powerful tool for growing wealth, but determining the right mix of international and U.S. stocks is crucial. In this comprehensive guide, we'll explore the key considerations for international and U.S. stock allocation, including diversification, risk, and potential returns. By understanding these factors, investors can make informed decisions and optimize their portfolios.

Understanding Stock Allocation

Stock allocation refers to the percentage of an investment portfolio dedicated to stocks. A well-diversified portfolio typically includes a mix of international and U.S. stocks, as well as other asset classes like bonds and real estate. The goal is to balance risk and return, ensuring that the portfolio performs well across different market conditions.

International Stock Allocation

International stocks offer investors exposure to diverse markets and currencies, which can provide a level of diversification that is not possible with U.S. stocks alone. However, international stock allocation requires careful consideration of several factors:

- Market Conditions: Investors must understand the economic and political landscapes of the countries in which they are investing. This includes analyzing factors such as inflation, interest rates, and geopolitical events.

- Currency Fluctuations: When investing in foreign stocks, currency fluctuations can impact returns. It's important to consider the potential for currency appreciation or depreciation against the U.S. dollar.

- Diversification: Investing in a variety of international stocks can help reduce the risk associated with investing in a single country or region.

U.S. Stock Allocation

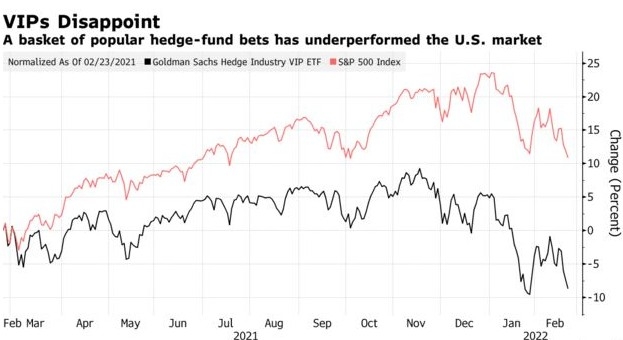

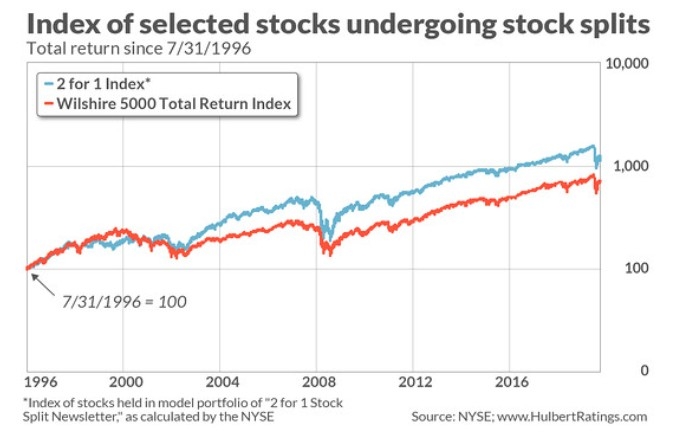

U.S. stocks have historically provided higher returns compared to international stocks. However, they also come with higher volatility and risk. When considering U.S. stock allocation, investors should consider the following:

- Market Leadership: The U.S. stock market has a history of leading global markets. Investing in U.S. stocks can provide access to some of the world's largest and most innovative companies.

- Diversification: Just as with international stocks, diversification within the U.S. stock market can help reduce risk.

- Economic Factors: The U.S. economy is a major driver of global economic growth. Understanding economic factors such as GDP, employment, and inflation can help investors make informed decisions.

Case Study: International and U.S. Stock Allocation

Consider an investor with a $1 million portfolio looking to allocate 50% to international stocks and 50% to U.S. stocks. Here's a breakdown of how they might allocate their investments:

- International Stocks: 50% of the portfolio could be allocated to emerging markets, developed markets, and a mix of large-cap and small-cap stocks. This diversification can help mitigate risk and provide exposure to different growth opportunities.

- U.S. Stocks: The remaining 50% could be allocated to a mix of large-cap, mid-cap, and small-cap U.S. stocks, as well as sector-specific funds.

By carefully considering international and U.S. stock allocation, investors can create a well-diversified and balanced portfolio that meets their investment goals and risk tolerance.

Conclusion

International and U.S. stock allocation is a critical component of any investment strategy. By understanding the key factors that influence stock allocation and diversification, investors can make informed decisions and optimize their portfolios for long-term success.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....