In the ever-evolving landscape of the financial world, understanding the current US stock market sentiment is crucial for investors and traders alike. This sentiment reflects the overall mood and outlook of market participants, which can significantly impact stock prices and market trends. In this article, we will delve into the latest developments and insights regarding the current US stock market sentiment.

The Current State of the US Stock Market

As of the latest data, the US stock market has been experiencing a mix of optimism and caution. This duality can be attributed to several factors, including economic indicators, geopolitical events, and corporate earnings reports.

Economic Indicators

One of the primary drivers of stock market sentiment is economic indicators. In recent months, the US economy has shown signs of strength, with low unemployment rates and steady GDP growth. However, concerns about inflation and rising interest rates have created a sense of caution among investors.

Geopolitical Events

Geopolitical events, such as trade tensions and political instability, have also played a significant role in shaping the current US stock market sentiment. These events can create uncertainty and volatility, leading to fluctuations in investor confidence.

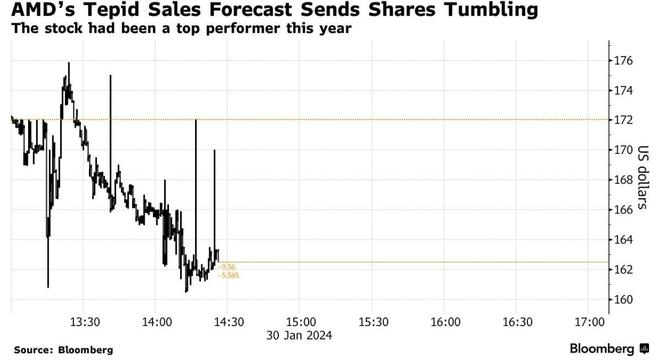

Corporate Earnings Reports

Corporate earnings reports are another critical factor influencing stock market sentiment. Companies that exceed earnings expectations tend to see their stock prices rise, while those that miss expectations may experience a decline. In recent quarters, many companies have reported strong earnings, contributing to the overall positive sentiment in the market.

Key Sentiment Indicators

To gauge the current US stock market sentiment, several key indicators can be analyzed. These include:

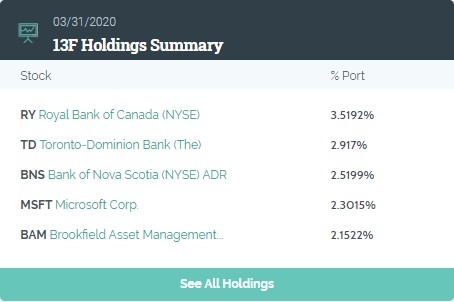

- Market Indices: The performance of major market indices, such as the S&P 500 and the Dow Jones Industrial Average, can provide valuable insights into the overall market sentiment.

- Volatility Indices: The VIX (VOLATILITY INDEX), also known as the "fear gauge," measures the market's expectation of volatility. A higher VIX indicates increased uncertainty and caution among investors.

- Sentiment Surveys: Surveys of investors and traders, such as the American Association of Individual Investors (AAII) survey, can provide a snapshot of the current sentiment in the market.

Case Studies

To illustrate the impact of stock market sentiment, let's consider two recent case studies:

- Tech Stocks: In the first half of 2021, tech stocks experienced a significant surge in popularity, driven by strong earnings reports and optimism about the future of the industry. However, concerns about valuations and potential regulatory changes led to a pullback in tech stocks later in the year.

- Energy Sector: The energy sector has seen a surge in investor interest due to rising oil prices and the increasing demand for energy resources. This has been reflected in the performance of energy stocks, which have outperformed the broader market in recent months.

Conclusion

Understanding the current US stock market sentiment is essential for investors and traders looking to make informed decisions. By analyzing economic indicators, geopolitical events, and corporate earnings reports, we can gain valuable insights into the mood of the market. As always, it's crucial to stay informed and adapt your investment strategy accordingly.

us stock market live

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....

google stock price-Access our proprietary algorithm that analyzes 5,000+ data points to identify undervalued stocks with high growth potential. This tool is normally reserved for institutional clients.....